“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else – if you run very fast for a long time, as we’ve been doing.”

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

– Through the Looking-Glass, by Lewis Carroll

We live in an age of unparalleled technical advance, with the accumulation of scientific and technological knowledge enabling humanity to do things that were previously unthinkable.

The revolution that came with the smartphone, for example, has enabled new businesses such as Uber and AirBnB to upend traditional business models, introducing much-needed innovation into industries with low productivity growth.

All of this, however, fails to appear in the growth statistics. Aside from a few highly productive large corporations, and the fabled “unicorn” startups that every VC dashes to find, the vast majority of the economy remains stagnant, with productivity growth in the UK remaining near zero.

It seems that, like Alice, we are running faster to stay in the exact same place.

What can explain this phenomenon? Why are new technologies failing to galvanise the British economy?

A certain degree of lag between the development of new technologies and widespread economic effects is only to be expected. But this cannot account for the dismal improvements in recent years. Thirty years later, Solow’s paradox – that the IT boom failed to boost productivity throughout the economy – can still not be accounted for.

Or could it be that these new technologies are not, in fact, as revolutionary as we think – especially when compared, for example, with electricity?

Some people have argued that this problem is partly an illusion. GDP, they say, was designed for a manufacturing age in which increases to output were much easier to assess: today’s improvements in services and free websites and downloads go unaccounted for. In 1996, a laptop would have cost 20 times more than its equivalent today, and be nowhere near as powerful: that is of economic benefit, even if it does not show up in the statistics.

Yet while there is a strong case to made for adjusting the way we measure growth, there is an undeniable lack of productivity improvements in many sectors of the economy.

In The Innovation Illusion, authors Frederik Erixon and Björn Weigel argue that recent gains have mostly been in “fun” areas such as mobile gaming; improvements in fields such as industrial robotics are less enchanting.

In the UK, while the startup scene is accelerating, the survival rate for new businesses is low, with a survey of entrepreneurs citing the complexity of the tax system, lack of available capital, and too much red tape as the top three barriers to growth.

If economic growth is going to rise, businesses need to devote capital to innovation. Yet as a percentage of GDP, research and development spending has been on a declining trend. And there is a broader problem. Strategy&, the strategy consulting unit of PWC, found that there is no statistical relationship between increasing R&D and sales.

This means that even if firms spend more on producing new technologies, there is still a general failing to capitalise on these innovations. This may serve as a disincentive to future innovation if firms fail to account for market risk.

Today’s UK entrepreneurs generally live in a world where, once their business becomes successful, investors take over and turn it into a traditional business, or they sell themselves off to a considerably larger firm. The UK leads Europe in startup exits – but these firms are far more likely to be acquired or privately held than to go public. In the second quarter of 2016, only one out of 136 exits was an IPO.

In the field with the most promise for increasing productivity, artificial intelligence, a few large firms such as Google, Microsoft, Amazon, and Apple have been dashing to purchase successful startups, many of which are found in the UK. While this brings investment to our shores, it also restricts the domains in which the technology is applied.

So what can we do? One obvious point is that the least innovative fields are also the most heavily regulated. For example, the area with the most significant decline in R&D spending, telecommunications, is also one where the UK performs poorly on a global scale, and one with very restricted competition.

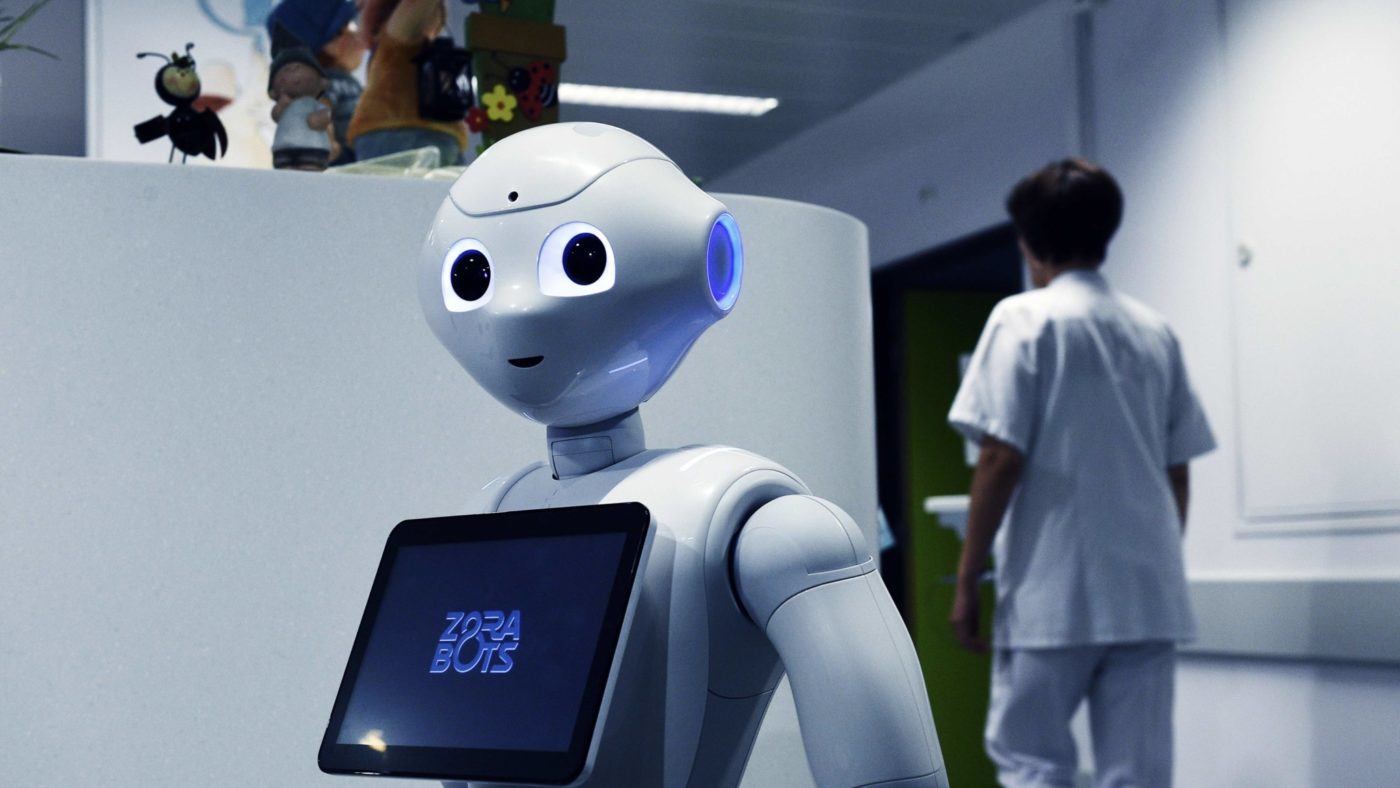

The same is true of the public services. Even its most ardent supporters are willing to admit that the NHS is at breaking point. A King’s Fund study highlighted some of the potential technological advances that could be adopted by the NHS. But the lengthy approval processes for medical innovations, and the costs of companies having to go through both the FDA and EMA due to lack of mutual recognition, serve as barriers to implementation.

On top of that, there is the vast cost of administrating the current healthcare system – which means that there is little money left to devote to innovation. Recent attempts by the NHS to introduce health care technologies, such as the trialling in London of a Machine Learning powered 111 app, are steps in the right direction. But the wider failure to improve health care holds back the overall growth of the economy.

Nor is the NHS alone. The recent Southern Rail fiasco came about because of union resistance to automating the opening and closing of train doors, meaning that only drivers, and not conductors, were necessary for train operation. The union eventually backed down, but in the process managed to cost the taxpayer at least £50 million, and the economy hundreds of millions more.

Away from the public sector, there are areas where rapid improvement is certainly possible – such as financial services, where the UK is as a world leader. Yet onerous regulations are again a barrier to growth, insulating incumbent institutions from heavy competition. (Recent attempts by the Financial Conduct Authority and the Bank of England to help financial tech firms grow, and provide a “sandbox” environment free from regulatory meddling when trialling new ideas, are steps in the right direction.)

Where innovation is most necessary, however, is in the energy sector, where rising costs have been holding back innovations in fields such as air travel. An ageing and outdated network infrastructures keep costs high, while making access and transport of necessities such as electricity and gas more difficult. Green regulation, and the slowdown in growth of nuclear power, have made tapping into environmentally friendly technologies more difficult, and kept the costs of green technology unreasonably high.

There is, in other words, a mismatch between our national technological potential and the economic reality.

The global economy has barely been growing since the financial crisis, and despite the UK having had a better year than expected, it is still nowhere near historic growth levels.

As the population ages, increasing the burden on public services and the public purse, improvements to productivity offer the greatest potential for prosperity.

Yet if current trends continue, and the barriers to market entry continue to discourage technological utilisation, we’ll end up running faster and faster only to remain in the same place.