In Kenya, the birthplace of mobile money and agency banking, we are all well aware of how helpful financial tools can be in the lives of low income people. Financial service providers have given millions of people safe options to save and pay, harnessed social networks for remittances that help vulnerable families cope with emergencies, and introduced innovative ways to finance assets in remote rural areas.

But we also know that low income families continue to deal with many serious money problems. For example, in 2015, 42 per cent of families in Kenya reported going without food at some point during the year, 35 per cent reported going without medicine or medical treatment when needed and 60 per cent of families with children reported that a child had been sent home from school due to an inability to pay school fees.

Like many in the financial inclusion world, we have been trying to imagine how the financial system might go even farther to reduce avoidable hardship and deliver real value to low income people.

The 2012-2013 Kenya Financial Diaries study was a great tool for helping us think about how to focus our efforts and showed us how a wide range of formal and informal tools fit into ordinary people’s lives.

In late 2015, FSD Kenya and BFA (Bankable Frontier Associates) again partnered to conduct a follow up study to understand how financial services were (or were not) changing people’s lives and shaping their economic futures. We explore the data and stories from this effort in a series of three new reports: Trickling down and climbing up, Small “b” biashara and Finance & Fortune.

Despite setbacks, Kenya’s economy has been growing and infrastructure services expanding. In 2014, GDP grew by 5.3 per cent and connections to the national electricity grid grew by 33 per cent, from 3 million to more than 4 million connections.

While only careful analysis of national household surveys will tell us for sure whether recent growth has been inclusive, about half of the families in the Diaries study felt their economic situation improved between 2013 and 2015, and 53 per cent grew their real per capita income by more than 20 per cent.

Improvements unfolded in a variety of ways, but the leading factor reported by respondents was increased income from starting or expanding a business.

In Matthew’s case, it was a large educational investment that paid off. When we last saw him in 2013, Matthew – a 24-year-old from Central Kenya with big dreams to finish his college studies in tourism – was in financial distress. His college fees were already an enormous burden.

On top of that, his brother was hospitalised with a fractured pelvis and a bill of KES 75,000 (equivalent to five months of household income). The two weren’t sure how they would clear the bill, but hoped their welfare group (a collection of 200 family and friends who committed to contribute to any member who had a death or hospitalisation) back in the village would help.

Matthew was always late paying for college fees, but kept sneaking into class hoping to find money before exams. He paid what he could when he could. Sometimes he would get a cheque from a government programme, but mostly he used the income he earned from writing essays online for other students or designing posters and greeting cards for local printers.

He only owned a few physical assets—a few plastic chairs and a mobile phone— but lost them to moneylenders and his local shopkeeper when he couldn’t pay his debts. Things were really, really hard, but he hoped that finishing college would change his fortune.

It did. Two years later as a server in an upscale café, Matthew was earning a regular salary that resuscitated a dormant bank account, funded automatic deductions for health insurance premiums and provided extra financial breathing room that enabled him to send money to his family using M-PESA.

With regular cash flow, Matthew got the confidence to start borrowing with M-Shwari (a mobile banking product by CBA and Safaricom that offers an interest-bearing savings account and a 30 day loan facility), relieved that his assets were no longer at risk.

Financial services weren’t the most important driver of Matthew’s rise out of poverty, but they were helpful along the way, just as they were for others. In Mombasa, Henry told us about how his mother took a microfinance loan for school fees for one of his siblings. Henry and his brother help her with loan payments using M-PESA.

Others used savings group payouts to finance new, lower cost electricity connections. Still others have found new, helpful ways to save and manage short term cash flow with M-Shwari.

Despite rising incomes, climbing out of poverty was a challenge. Households who were living in conditions of poverty in 2012 (earning an income per person below $2 per day) were three times more likely to remain in poverty two years later than to leave it.

Many respondents face serious challenges, particularly in paying for secondary and tertiary education, dealing with health shocks within their social networks, and being able to make business investments that generate positive returns and help households seize opportunities for long lasting increases in their incomes.

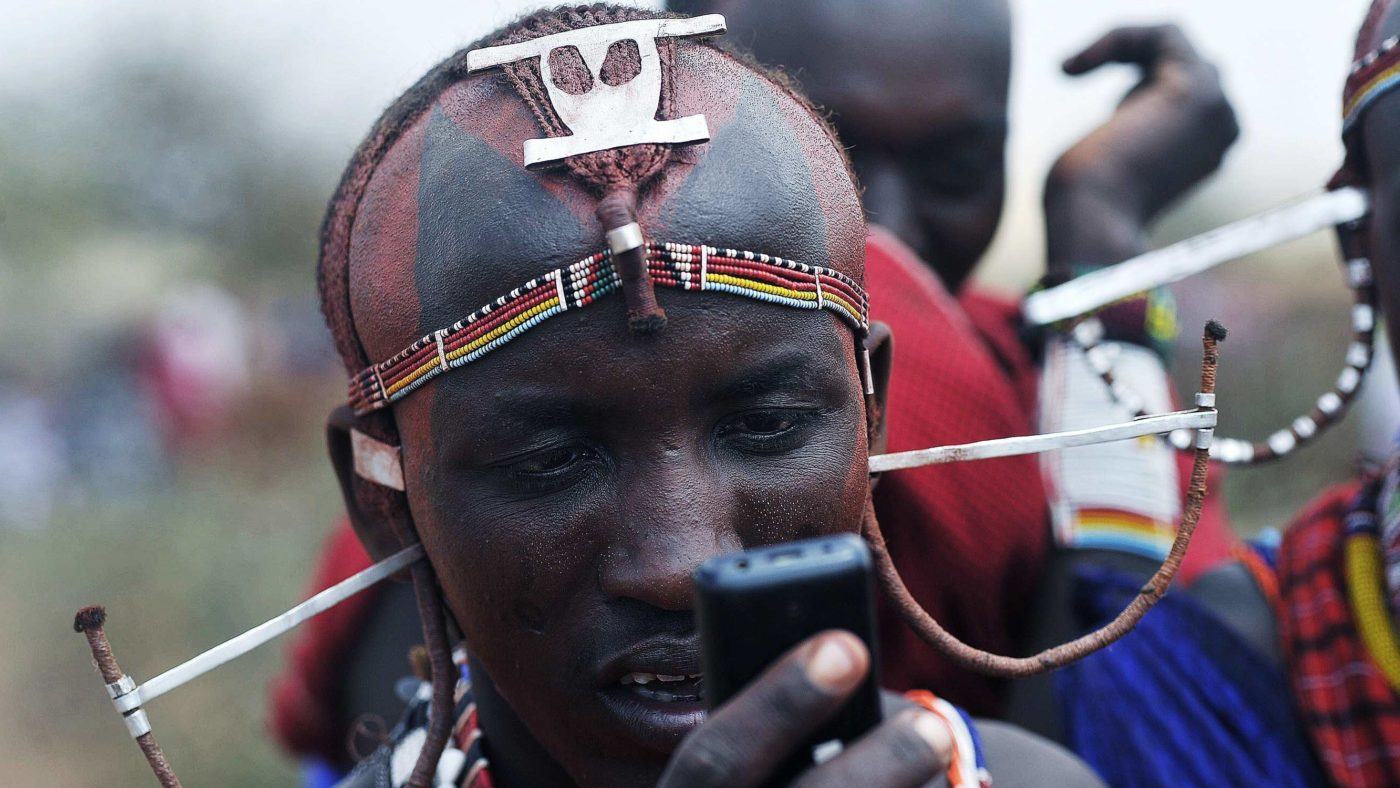

Here financial services can play a bigger role, especially in Kenya where mobile phones, agent networks, and mobile money have significantly reduced geographic and cost barriers for traditional and new kinds of services. With over three quarters of its adult population now using either mobile money or banking services, Kenya’s financial sector scores high in terms of reach.

We believe it’s now time to improve the country’s scores on significance, helping existing tools become more useful and by enabling new business models that leverage the widespread retail banking, payments and communications infrastructure to deliver solutions that solve problems across multiple real-world domains, like agriculture, health and education — areas that Diaries households continue to show us really matter for improving economic wellbeing. This will be FSD Kenya’s focus over the next five years, alongside efforts to address issues around trust and affordability within the financial system.

Research like the Financial Diaries provides a valuable starting point in this pursuit, but consumer insights alone won’t get us all the way there. The incentives and capacity of financial service providers need to also be aligned towards the goal of findings better ways to design and deliver value propositions that benefit poorer market segments.

Eighty-two percent of Diaries households in the follow up study told us they expect their economic situation to improve over the next five years. Given all of the progress we’ve already seen in Kenya’s market, we are similarly hopeful that five years from now, we will see an even more impactful role for finance in Kenya.

This article was originally published by the World Economic Forum. See the original piece here.