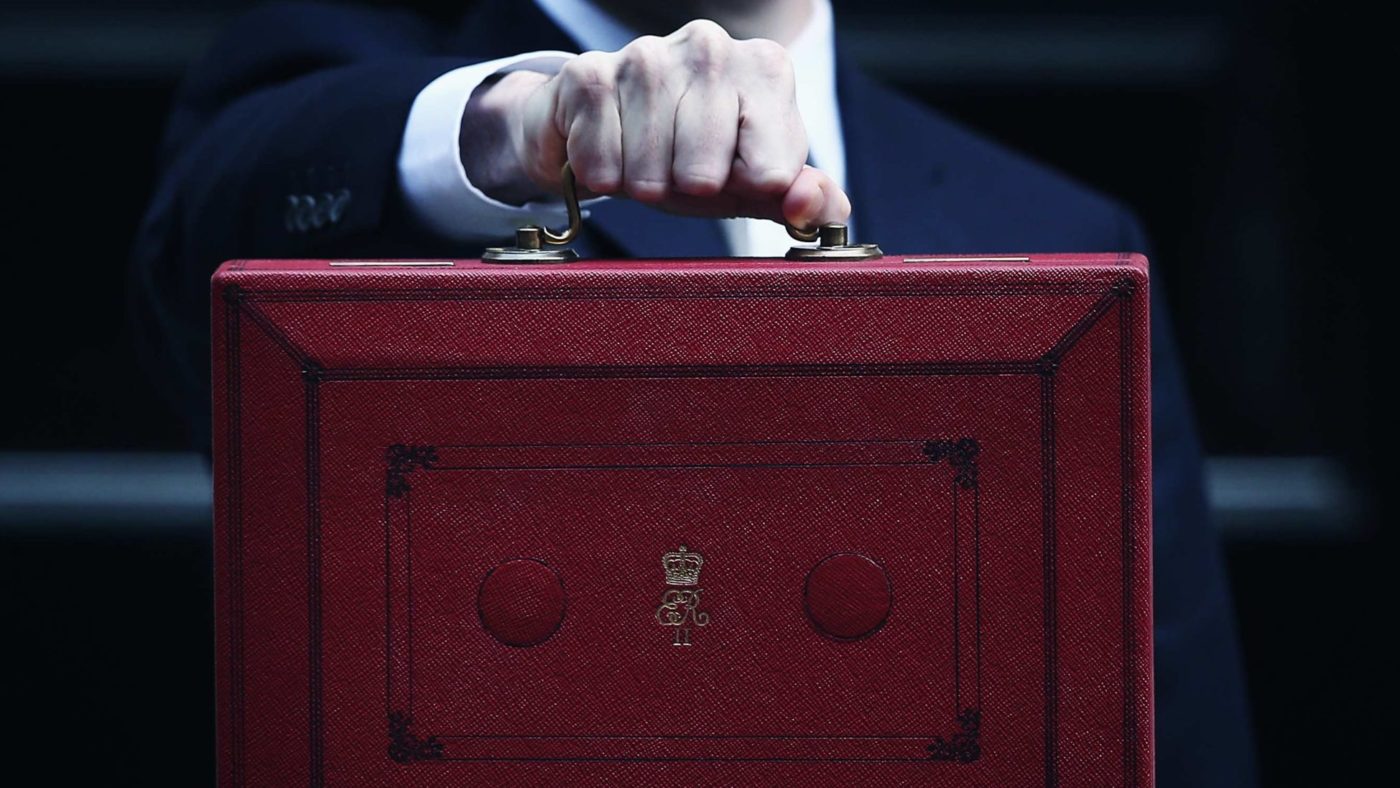

This time last year the then prime minister and chancellor triumphantly declared that austerity was over. Philip Hammond, pointing to the fact that the Conservatives had managed to cut the deficit, claimed there was now room for a modest increase in public spending. What is more, with Sajid Javid making a raft of spending announcements, it would seem as though the age of austerity really is over.

Austerity is a controversial subject, with many of those on the left arguing that it was never necessary in the first place and was only introduced for political reasons. So it would be useful to look back over the past decade and answer a few questions. Does austerity work? Is it possible to be fiscally conservative and still win elections? Could the policies of the government from 2010 really be classed as austerity? And, what should the government do going forward?

Does austerity work? The answer is: it’s complicated. As explained in the excellent new book Austerity: When it Works and When it Doesn’t by Alberto Alesina, Carlo Favero, and Francesco Giavazzi, it depends what you mean by austerity. It’s a book which is very technical in places, has countless charts and some of the chapters assume at least an undergraduate level of economics education. However, it is still well worth reading. The central premise of the book is that austerity can and does work, but only under certain circumstances.

The authors analyse thousands of fiscal measures adopted by sixteen advanced economies since the late 1970s, and assess the relative effectiveness of tax increases and spending cuts at reducing debt. They show that spending cuts have much smaller costs in terms of output losses than tax increases. They also show that spending cuts are much more successful than tax increases at reducing the growth of debt, and can sometimes even result in output gains, such as in the case of expansionary austerity.

Therefore, the key to getting a nation’s finances in order is not to simply raise taxes, nor is it to raise taxes while also cutting public spending. The most effective way is to just cut public spending.

Is it possible to be fiscally conservative and still be popular with the electorate? The authors of austerity argue that it is. They point to numerous examples in different countries since the 1970s that demonstrate austerity is not necessarily as politically toxic as many people assume. We have seen this in the UK as recently as the 2015 election. It seems like a lifetime ago, but David Cameron and George Osborne’s message of a long term economic plan which involved eliminating the deficit helped to deliver an historic Conservative majority.

Which brings us onto our next question: did the UK actually experience austerity? Those on the sharp end of cuts to spending would answer ‘of course we did’. However, taken in the round the government’s programme was a mild form of austerity. As the former Greek finance minister Yanis Varoufakis revealed in his memoirs, George Osborne agreed with him when he said: ‘While we may disagree on the merits of austerity, you are not really doing much of it, George, are you?’

So, given all this, what should the government do?

Although the deficit has been reduced, the national debt remains a problem – we have had short term drop, but debt is still predicted to increase dramatically over the coming decades. This is serious, because a high level of national debt can lead to an increase in the yields paid on UK sovereign bonds. This is because if investors believed that the UK’s national debt was so high that it would be at risk of defaulting on its debt, or that the country would inflate them away, they would need to be incentivised to purchase the UK’s gilts by high yields.

What is more, debt can have a very negative impact on economic growth. For example, borrowing can crowd out other investment as investors loan money to the government, rather than to the private sector. Nations typically see growth slow when their debt levels reach 90% of GDP, with the median growth rate falling by 1% and average growth falling by even more. Furthermore, research focusing on the US has found that raising the Federal deficit has an adverse effect on the economy by reducing private sector investment, economic growth, and employment.

Given that the UK may very well crash out of the EU without a deal at the end of this month, we need to be cautious. Whatever the nature of our new relationship with the EU, the UK’s economy is likely to experience shocks and a high degree of uncertainty. As such, it is vitally important that our public finances are in order so that the government will have more freedom to respond to any downturn in the economy.

Then there is the politics of it all. It’s important to remember that fiscal conservatism can be popular with the electorate and it worked well in 2015 and to a lesser extent in 2010. The Conservatives should not expect to win the next election by promising massive increases in public spending.

For economic and political reasons, the Conservatives should return to being the party of fiscal discipline.

This doesn’t mean cuts to essential public services which hit the most vulnerable the hardest, it means cutting wasteful spending. Scrapping HS2 and reducing the size of the civil service are obvious starting points.

It also means identifying ways of making public services run more efficiently. This includes increased use of automation and AI, which has the potential to bring huge savings to the public sector while also improving the quality of service.

Finally, it means having a sensible tax policy. A system where taxes are low, flat, and simple will allow businesses and individuals to increase investment and thereby increase productivity and grow the economy. A side benefit of this is an increase in revenue for the Treasury.

Austerity can work when done properly. What is more, it can also be a vote winner. Given that the economy is about to experience a period of shock and uncertainty, and with a possible general election looming, now is not the time to embark on massive increases in public spending.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.