It should go without saying that providing efficient public services is vital to any functional society, and that when opportunities are missed to increase productivity or trim the fat in the public sector, it inevitably comes at the expense of taxpayers. Yet restating this simple truth seems to do little to curb the cost-of-government crisis that we find ourselves in today. At the TaxPayers’ Alliance, we do our best to expose government waste, but these problems run deep and it can often feel like stemming the tide.

Despite the ongoing struggle, there was some cause for optimism when the head of the National Audit Office, Gareth Davies, used his annual speech to discuss the billions that could be saved by boosting public sector productivity. Among other issues, Davies highlighted procurement as an area for improvement. He insisted that value-for-money deals must sought over the ‘patchy’ way deals are currently made. The notorious HS2 fiasco was also mentioned as an example of poorly managed infrastructure projects overrunning and taxpayers being left to foot the bill.

All the recommendations made by Davies should be taken seriously. Cutting waste, increasing efficiency and saving taxpayers’ money are crucial aims when we’re contending with a record tax burden.

However, this risks obscuring the biggest elephant in the room. Putting aside the grim probability that little of what Davies suggests will be taken on board, the issue is that any savings made will have little effect in the context of a growing appetite for an ever-expanding state. The most likely outcome under the status quo is that any savings made by public sector productivity will be snatched back by different elements of the state, and taxpayers will continue to toil under high rates.

Davies came close to acknowledging this reality when he stated in his introduction that ‘demographic changes mean demand for many services will continue to rise’. The problem is not only that public services are underachieving at present, but that government spending as a whole is unsustainable. This is not a problem that can be solved by increasing public sector efficiencies alone, however admirable that goal is. The suggestions made may work within the parameters set by the state, but what is truly necessary is an overhaul of the way state business is conducted.

This touches on a broader point. We have heard a lot over the last few years about the importance of economic growth. Like enhanced public sector productivity, this is something we should naturally be striving for. However, you cannot outgrow your problems if any gain is coupled with an insatiable appetite for consumption.

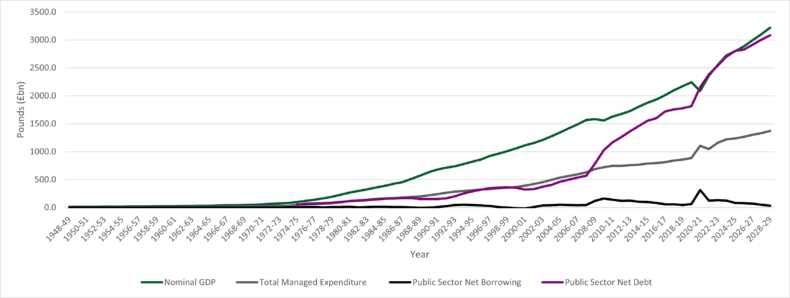

The graph above demonstrates this issue. Since 2008, the UK’s debt has shot up, leaving it level-pegging with GDP. At one point, in March 2023, UK government debt was equivalent to 100.5% of GDP. Total Managed Expenditure (government spending), although not as drastic as UK government debt, is soaring and shows no sign of slowing either. The benefits of economic growth are drowned out by spending increases, debt and deficit.

Even so, these figures do not show the full picture. There are unrecognised liabilities worth trillions of pounds that are not taken into account. Public sector pensions, for example, are a largely unfunded scheme, meaning they are paid for by taxpayer funds in the future, but are not recognised as part of what we know as the national debt. At the end of 2020-21, public sector pension liabilities were over £2.3trn. Once again, taxpayers will be footing the bill.

Another way to get a picture of the scale of the spending problems the UK is currently facing is by looking at the interest payable on government debt. In June 2023, the figure stood at £12.5bn. To put that in context, Davies is talking about making savings of £8-10bn through enhanced productivity. The interest paid on government debt only exists as a consequence of massive government spending, which shows no sign of slowing.

The bottom line is this. In order to see the benefits of public sector productivity and economic growth, the government must prioritise cutting spending; not only as a means to reinvest in public services or increase the reach of government, but to ease the burden on taxpayers and put the economy on a stable footing for a sustainable future.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.