On Wednesday, the Chancellor of the Exchequer addressed the nation to ‘kickstart growth’. As ever with these big political speeches, she spent much of it pointing to things that this Government has already announced and going ‘ooh, isn’t this brilliant,’ while the remainder had already been leaked heavily to the press. Nonetheless, there were some genuinely positive aspects.

Take the Ox-Cam arc – or ‘Growth Corridor’ as it has now been re-named – which will provide vital lab space for R&D projects and places for highly-skilled people to live within commutable distance. Or the new reservoirs, an important component of this project, without which it will be impossible to provide the water for the new homes and businesses. And there’s the promised third runway at Heathrow, which will boost trade, reduce flight prices for Brits and actually reduce noise and pollution. Of course, we’ll have to wait and see if the Government actually manages to get any spades in the ground, but if it does it will have passed its first major growth test.

However, there are a number of pitfalls, many of which have been laid by the Chancellor herself in her Autumn Budget. As many others have also pointed out, the increase in employer National Insurance contributions is forcing businesses to cut jobs, freeze hiring, keep pay low and, in some cases, shut up shop altogether. Meanwhile, the Government’s own abolition of the non-dom has been driving our wealth-creators away. The Adam Smith Institute has recently calculated that the number of millionaires who have already left the country last year is the fiscal equivalent of over half a million average taxpayers. ‘The best place in the world to be an entrepreneur’ we are not.

Nor can we be fulsome in our praise for all the Government’s planning announcements. Yes, it has brought back house-building targets, but we shouldn’t forget it actually slashed them in our major cities. London’s target was cut by 20%.

And there’s another potential problem with the Chancellor’s approach. For all the fine rhetoric on growth and doing things differently, the Government’s natural reversion to ‘safetyism’ was still present. Regulators, the very organisations which strangle growth, are for some reason still being asked how to achieve it. The private sector, supported by a permissive regulatory environment, is what creates growth.

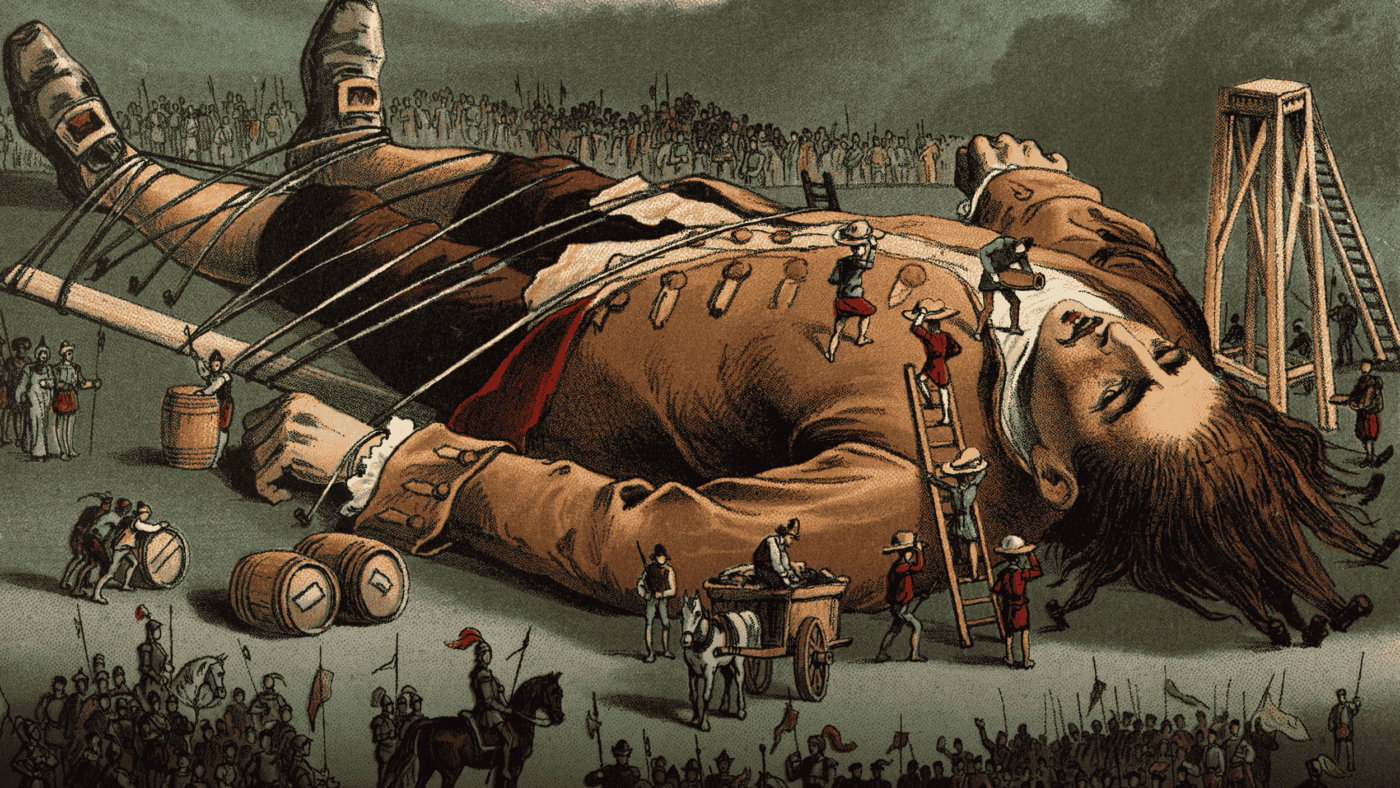

Let’s take public procurement – with £407 billion a year in taxpayer funds spent on buying goods and services, there are deeply embedded blockers and cost inflators. The Social Value Act, a seemingly innocuous coalition-era piece of legislation, pushes billions in costs on taxpayers for consultants and third sector objectives outside of the scope of the actual objectives of the procurement. Indeed, the Act insists that ‘value for money’ is now a thing of the past – instead, taxpayer money should be spent achieving less-financially sound goals, such as Net Zero and equal opportunities for stakeholders. How can Britain grow when it is constrained by such shackles?

Then comes the threat of industrial strategy – the very mechanism which has destroyed major British cities, as highlighted by my colleague Sam Bidwell. ‘Industrial strategy’ is effectively a by-word for picking losers, subsidy regimes, regulations perfectly calibrated to destroy competition and expand corporate welfare. Manufacturers are understandably frustrated with the state of affairs, but an industrial strategy won’t help them – the Government would do better to just get out of the way.

Without a considerable paring back of the taxes which have curtailed the capitalist initiative of so many entrepreneurs and businesses, or the wholesale removal of regulations impairing enterprise, Britain will never escape its economic malaise.

The Government must look to be bolder, unlocking energy superabundance with a rapid rollout of SMRs, legalising fracking, removing the blockers on North Sea oil and gas and terminating pernicious taxes such as stamp duty, inheritance tax and NICs.

If the Government’s missionary zeal never transitions from theory to practice, its promised economic growth will be, at best, limited.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.