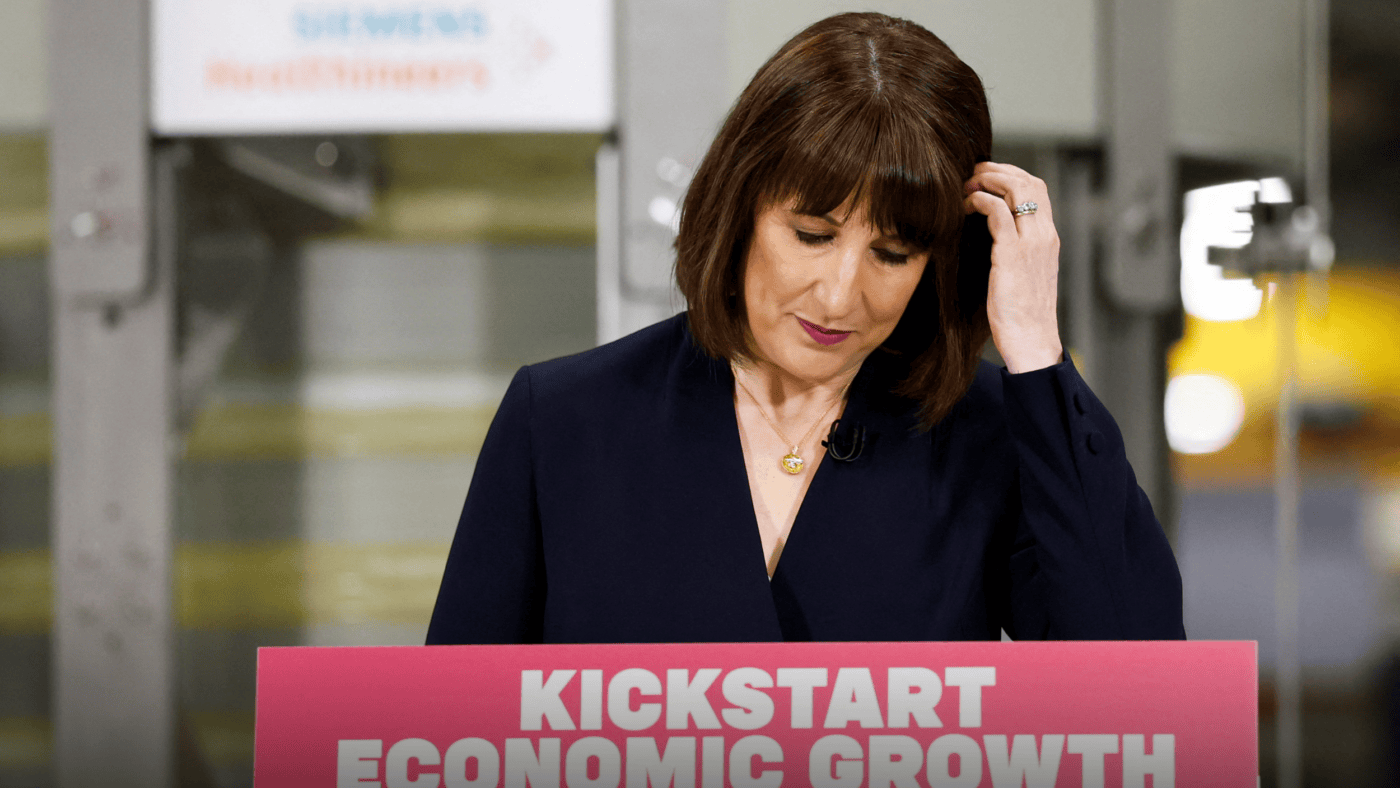

The Chancellor’s big growth speech on Wednesday morning was so widely trailed that it contained few surprises. But it was still the clearest and most coherent statement of her economic philosophy and plans so far.

Before diving into the detail, it is only fair to welcome the change of tone. It has been refreshing to hear the Chancellor come out fighting for growth. People have already heard more than enough about the need for ‘fiscal discipline’ and ‘an iron grip on the public finances’. They have been crying out instead for specific actions to kickstart growth and today we heard a long list.

Indeed, recent polling by Opinium confirms that, while many Brits may not like President Trump as a person, they do like his policies. Rachel Reeves should be applauded for trying to channel some of this US positivity. Bigging up ‘Europe’s Silicon Valley’ is a good example.

And while she did not mention the B-word, there were some ‘Brexit benefits’ too, including the prospect of new trade deals with the US and with India. The opportunity to regulate AI more smartly outside the EU can be added to the pile.

But three big questions still need to be answered. The first is how much of what Rachel Reeves is proposing is really new and, even more importantly, how much will actually be delivered?

Needless to say, successive governments have promised to ‘go for growth’. Many of the initiatives in the current package are simply the development of ideas put forward by the Sunak administration, or were part of Liz Truss’s Growth Plan, or date back even further.

Examples here include pension reforms to unlock private ‘patient capital’, rewriting listing rules, strengthening the growth duty on regulators, and fast-tracking planning approval to ‘get Britain building again’.

Moreover, some of the headline-grabbing announcements today – notably the redevelopment of Old Trafford – would surely have been approved anyway by whichever party happened to be in power.

Basically, the new Government has to demonstrate that it can do much the same things to boost growth as many others have promised before, but better. This is a huge challenge, not least given the tensions between Rachel Reeves and colleagues with agendas of their own.

These tensions are only likely to grow ahead of what is certain to be a tough Spending Review in the spring. The Chancellor cannot necessarily rely on unwavering support from the Prime Minister either. Many are already worried about the lack of economic and financial expertise in No.10, let alone the Cabinet as a whole.

This leads on to the second problem, which is the difficulty of reconciling the pro-growth agenda with so much else that the Government is doing – notably the increased intervention in labour markets, the rush to ‘Net Zero’, and of course the further increases in the tax burden in Rachel Reeves’ own Budget.

This task is not completely impossible. The government’s impact assessment of the Employment Rights Bill made a decent attempt at finding some positives to offset the additional cost burden of £5 billion a year on businesses.

The rush to Net Zero might eventually deliver lower energy prices and greater security of supply, even though it probably won’t. The latest independent analysis from Cornwall Insight suggests that the Government is on track to fall well short of its ‘Clean Power 2030’ targets. As the report notes:

…pushing too quickly could have unintended consequences, diverting resources to short-term solutions at the expense of longer-term energy security and sustainability.

The increases in taxes could also still be spun as a one-off measure that will put the public finances back on track, though it is unclear whether anyone really buys that either. Instead, the tax increases have undermined the foundations by crushing confidence in the economy.

This leads onto the third problem – that all of this may be too little, too late.

It is important to grasp the scale of the challenge in the short term. Growth has ground to a halt. Indeed, the economy is almost certainly back in recession in terms of output per head, and perhaps in terms of overall GDP as well. Either way, the Office for Budget Responsibility’s forecast of 2% growth in 2025, which was baked into the October 2024 Budget, is now for the birds. We will be lucky to achieve half that number, and growth may even be slower this year than last.

Rachel Reeves’ decision to back Heathrow expansion neatly illustrates all of these problems. The Blair, Brown and May governments all backed a third runway as well, and yet nothing happened. There is still substantial opposition, including from within the governing party, given the apparent clash with other objectives, And even if the project goes ahead, it will be many years before it has any significant impact on growth.

Above all, there is a fundamental contradiction at the heart of what the new Government is trying to do. On the one hand, Rachel Reeves appears to recognise the need for government to get out of the way and allow the private sector to drive growth. But on the other, even she believes that a much bigger state is also part of the solution to the UK’s long-standing economic problems. This is unlikely to end well.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.