Politics cannot be done without “gifts” to voters. But every election promise has to be paid for. With budget crisis constantly looming around many governments face possible backlash when trying to spend more from public budgets.

However, there is always an option to hide the cost of a policy into prices of various products and services. It provides certain convenience – there is often a time lag before the market prices absorb the costs of a policy and when that happens, the growing price can be falsely blamed on a number of other reasons.

INESS recently focused its analysis on one sector, where state ownership and direct control remains very strong: energy. More specifically, we analyzed the consumer prices of electricity in Slovakia. The rising cost of electricity bills, especially for Slovak businesses, has become a popular topic in the last few years.

Despite a wholesale electricity (commodity) prices dive (from the tops of almost €100/MWh in 2007, the prices fell below €30/MWh in the meantime), the consumption prices in Slovakia did not fall significantly. In all consumption bands monitored by Eurostat, Slovak businesses pay one of the three highest prices of all 11 east-European member states. Energy prices are often quoted as one of the main reasons of problems of Slovak metallurgy sector. The biggest private employer in Slovakia, US Steel, is considering leaving the country. A smaller mill, Slovakia Steel Mills, is already bankrupted.

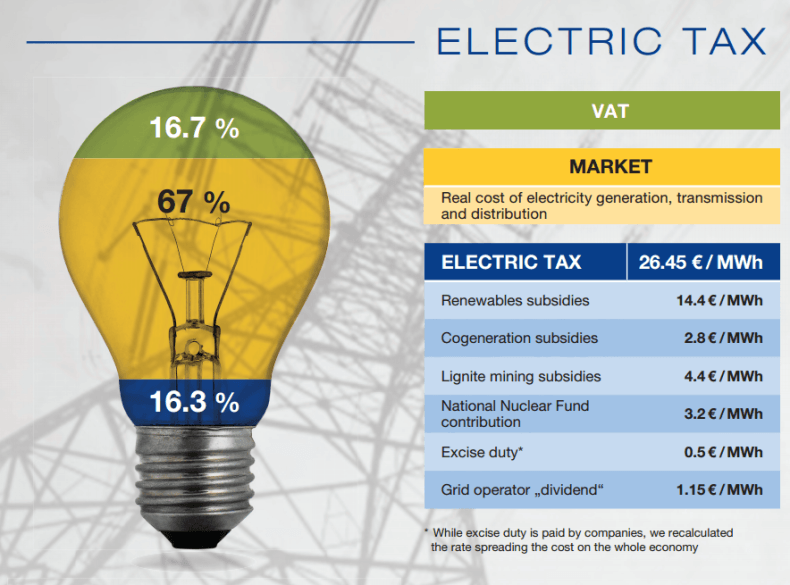

The high cost of electricity bills can be partly attributed to a phenomena we named “electricity tax”. This fictitious tax consists of various fees and surcharges, which are attributed to the consumption prices of electricity and can be traced to the costs of various policies, implemented by Slovak governments in the past. It reaches €26.45/MWh, which is 16.3% of average consumption price.

More than half of it is in the form of subsidies to renewable source of electricity (in Slovakia mainly photovoltaics). Almost an equal portion go to cogeneration support, to support a lignite powerplant (yes, Slovakia subsidizes its second biggest carbon dioxide polluter) and to the National Nuclear Fund, as a result of neglected reserve creation for decommissioning. Small fraction consists of excise duty on electricity. We also treated the dividends of the public grid operator, which flow to the state budget, as additional burden. A state-owned monopoly with a 10% profit margin has the option to either feed back into the budget, or lower the grid connection fees (which come among the highest in whole Europe, according to European Network of Transmission System Operators for Electricity).

In a democracy, the government has a mandate to pose green or social policies. However, to hide the costs of such policies in market prices is wrong. It makes the real costs of such policies non-transparent to voters and shifts the responsibility away. Every policy should be paid primarily from the public budget, so it can be always identified with the imposed taxes. This does not account only for Slovakia, since the practice of hiding policy costs in market prices is wide-spread around the world.