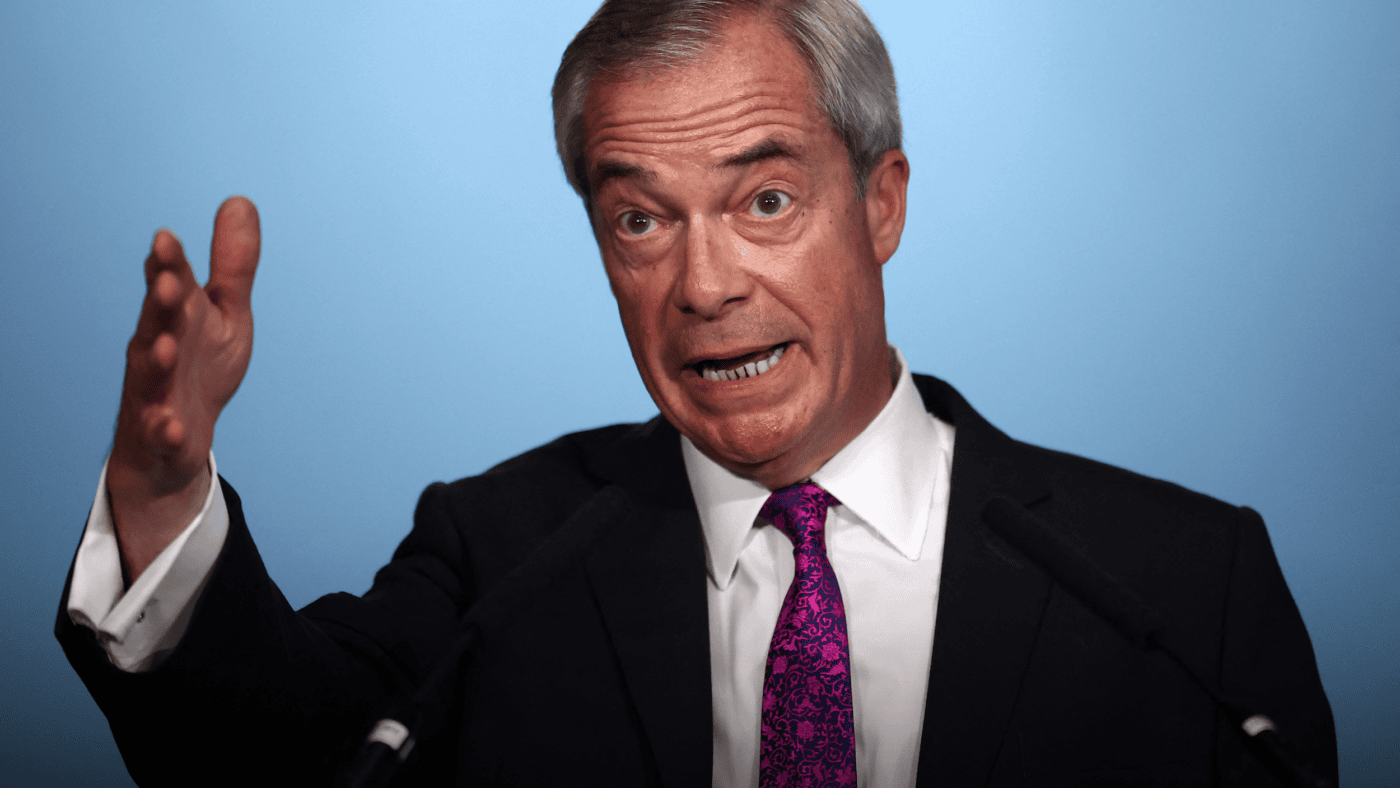

Nigel Farage made a bold pitch to British families this week, announcing Reform’s plan to introduce a fully transferable marriage allowance alongside promises to scrap the two-child benefit cap and restore winter fuel payments. Standing at a Westminster press conference, the Reform leader declared his party would help families feel ‘financially able’ to have children.

The marriage allowance proposal deserves serious attention, it represents genuinely sound tax policy that would create a significantly fairer system for families across the country.

The current system creates glaring inequalities that violate basic principles of good taxation. Consider this stark example: a household earning £50,000 annually faces dramatically different tax bills depending on how that income is split between partners. If earned by one person, the household pays £10,480 in Income Tax and National Insurance. But if two people each earn £25,000, the same household pays only £6,691 – a difference of nearly £4,000.

This isn’t just unfair; it’s economically destructive. The tax system should treat households with identical incomes equally, regardless of how couples choose to organise their working lives. Many families split work according to their specific circumstances – one spouse working part-time to care for children or elderly relatives, or taking career breaks during crucial family periods. The current system penalises these entirely reasonable choices, forcing families to make decisions based on tax considerations rather than what works best for their situation.

The principle at stake is neutrality: tax policy should not distort how families choose to earn their living. When the system actively discourages certain working arrangements, it fails this fundamental test.

Britain’s approach looks increasingly outdated when compared internationally. While the UK taxes single earners relatively generously – someone on the average wage pays about 21.4% of their gross income as tax, lower than France (28.1%), Germany (37.4%) or the US (24.4%) – we treat families far more harshly. A single-earner family with two children in the UK still pays 21.4%,compared to 20.8% in France, 19.8% in Germany, and a remarkable 5.1% in the United States. We’re not just being unfair to our own families; we’re making ourselves less competitive as a place to raise children.

Reform’s proposal for a fully transferable allowance would eliminate this inequality for many households. Under their plan, that £50,000 household would pay exactly the same tax regardless of how earnings are divided between partners. While it wouldn’t solve the problem for much higher-income families – that would require allowing complete income-sharing for tax purposes – it would provide substantial relief for low and middle-income earners who need it most.

The Centre for Policy Studies has long championed this approach. Our 2023 analysis showed that a transferable allowance would particularly benefit lower-income households, with an estimated cost of around £6.1 billion if extended to all married couples, or a more modest £3.6bn if limited to married couples with children.

Britain desperately needs to encourage family formation and support parents when they’re making crucial decisions about work and childcare. A tax system that penalises traditional family arrangements while rewarding dual-career couples makes little sense in a country facing demographic decline and an ageing population.

Moreover, this approach recognises economic reality. Families often function as integrated economic units, pooling resources and making collective decisions about earning, spending and caring responsibilities. The tax system should reflect this reality rather than treating each individual in isolation, as if family financial decisions happen in separate bubbles.

The current marriage allowance, introduced in recent years, already acknowledges this principle but only allows the transfer of £1,260 of personal allowance, providing tax relief of up to £252 per year. While welcome, this limited transfer barely addresses the scale of inequality facing single-earner families. A fully transferable allowance would represent a much more substantial step toward genuine tax neutrality between different family arrangements.

In terms of fairness and moving the tax system towards neutrality, Reform’s proposals are excellent policy. The marriage allowance stands on its own merits as a matter of basic equity in how we treat families with identical incomes but different earning patterns. It represents exactly the kind of targeted reform that recognises the economic contribution of unpaid care work and the diverse ways modern families organise their lives.

However, while the marriage allowance represents sound policy, Reform’s broader tax package raises questions about implementation and priorities. The party has also promised to raise the personal allowance from £12,570 to £20,000 – a change that would cost more than £50bn annually. Reform will have to find this money from somewhere and have not yet offered a credible plan for how they will finance the entire package. Without addressing these fiscal realities, even the most sensible individual policies risk being dismissed as unaffordable.

Nevertheless, Reform have settled on a policy that could combine sound economic principles with genuine support for families. A transferable marriage allowance treats households as the economic units they actually are, delivering both tax neutrality and practical help for families through straightforward, sensible change.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.