The Government’s long-awaited housing White Paper, due out tomorrow, is widely anticipated to herald a major government effort to boost house building. The need is obvious. Over the past 20 years average house prices in the UK have risen by about 150 per cent, after inflation, because we’ve failed to build enough new houses to keep up with the growth in households.

Or that’s what I used to think. But analysis of official data suggests this isn’t true. The obsession with supply is a red herring, and the real problems in our housing market won’t be solved simply by building more.

Are there enough houses to go round?

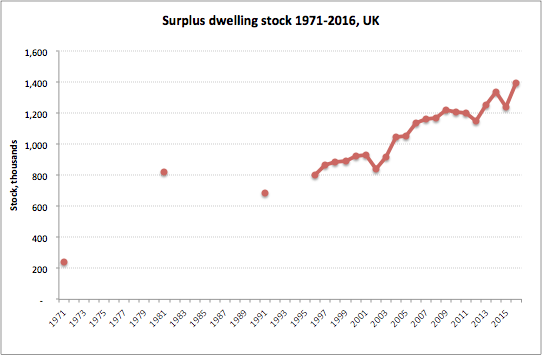

First, we can look at the raw numbers to see whether the housing stock has kept pace with household formation. Back in 1991 there were just over 3.0 per cent more houses than there were households in the UK according to government data. Today, using the Office for National Statistics’ latest household estimates, there appear to be 5.2 per cent more places to live than there are households that want to live in them.

In fact, growth in the stock of dwellings appears to have outstripped that of households over the past 50 years or so.

Source: DCLG tables 401 and 101; ONS households from 2011

So if there doesn’t appear to be a housing shortage, where has that perception come from? Two sources seem to be responsible. One is repeatedly exaggerated official forecasts of growth in the number of households in the UK. The other is a focus on house building numbers to the exclusion of other sources of new dwellings.

The number of households is growing slower than expected

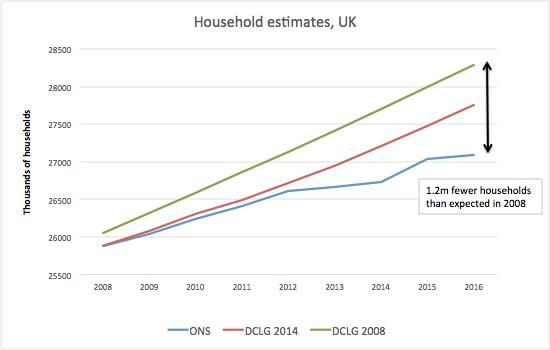

Estimates of UK housing need quoted by commentators tend to range between 250,000 and 300,000 units per year. These are invariably based on forecasts for the number of households produced by the Department for Communities and Local Government, the latest of which suggests annual UK household growth of about 260,000 from now to 2022.

But these forecasts have persistently overshot by a long way for many years. Take recent history. Back in 2008, DCLG forecast that about 280,000 households per year would form in the UK in the eight years to 2016. Even the department’s more recent projection suggested 235,000 per year over that period. In light of those expectations, it’s easy to see why you might presume there’s an undersupply problem when the housing stock is growing by less than 200,000 per year.

Yet the forecasts haven’t matched reality. The ONS uses census and the latest survey data to estimate that the actual number of households has been growing at just 152,000 per year since 2008 and 168,000 since the start of the century. Consequently, we now appear to have a whopping 1.2 million fewer households in the country than the government anticipated in 2008 (see chart). Even if we allow a healthy margin for error, UK housing need looks to be far below DCLG’s forecast.

Source: DCLG table 401 (2008-based and 2014-based); ONS

Why does this overestimate keep happening? The main cause is that forecasters have expected average household size to resume the descent it made from 1961 to 2001, from an average of 3.01 to 2.36 people per household. Shrinking household size implies more households for any given population.

In practice, average size flat-lined through the first decade of this century and, on ONS data, even appears to have been growing slightly since 2013. Consequently the demand for places to live isn’t rising anything like expected just a few years ago. Forecasting this kind of thing is obviously very difficult. But that’s all the more reason we should use data as it becomes available, rather than relying on forecasts based on 20th century trends.

New-build isn’t everything

The second reason for the perception of under-supply is commentators’ tendency to focus on house building rather than the net change in housing stock, which is what really counts.

Conversions, changes of use and demolitions all affect the net number of new houses each year. And since the start of this century, net additions have been about 10 per cent higher than the rate of new building. Looking at this bigger picture, the latest figures suggest we’re adding similar numbers of units as we were in the 1970s, even though building rates are now much lower.

Comparing the rate of building and household growth creates the misleading impression of a big slowdown in new supply compared to the past.

Are housing costs out of control?

So there doesn’t appear to be a physical lack of houses. But could spiralling costs of housing be suppressing household formation? Because housing costs are spiralling, right? Well, no, it doesn’t appear so.

The cost of housing is different from the price of a house. For renters the cost of housing is their rent. For owner occupiers it’s a combination of their mortgage interest, foregone income they could have earned on any equity, and maintenance costs such as fixing the roof every 20 years. Mortgage capital repayment isn’t a cost because it’s effectively saving in your house.

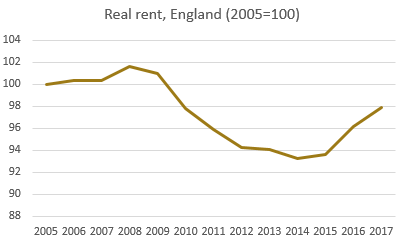

So what’s really been happening to housing costs? The ONS Index of Private Housing Rental Prices tracks rental prices over time on a like-for-like basis, and is the best rent indicator we have. It shows that far from spiralling, rents in England are still about 2 per cent below what they were in 2005 after inflation. Not much sign of a shortage there.

Source: ONS

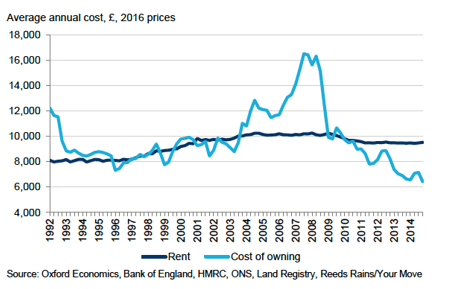

What about owner occupier housing costs? Well they’re more difficult to measure, but based on the average typical mortgage rate available at 75 per cent loan-to-value (applied to both the mortgage and equity portions of the average house price) and ONS estimates of depreciation rates for dwellings, combined with annualised versions of the relevant taxes, ownership costs looks like the light blue line in the chart below.

Cost of rent versus cost of owning

The true cost of owning a house, therefore, looks to have been falling since prices and interest rates dropped after the financial crisis. Indeed, we can see that the cost of owning has tended, with temporary divergences, to fluctuate around the cost of renting, which is exactly what we’d expect to see, according to simple asset pricing theory.

So housing costs, in either tenure, don’t appear to be high by recent historical standards. And that’s consistent with the data suggesting the surplus of dwellings is the highest it’s been since decent records began. While housing costs clearly have an impact on the number of households, this doesn’t seem to have been a problem that’s got worse recently.

An inadequate supply of places to live therefore doesn’t look like the house price culprit.

What about regional housing pressure?

Some argue that using national figures misses the point, that shortages are more local than that. And it’s true that rents in London are up by 7 per cent in real terms since 2005, even though they’re down everywhere else in the country.

But if there is sufficient housing stock nationally, then rising housing pressures and prices in London must have a counterpart of falling demand and prices elsewhere. In other words, a story of London shortages can’t explain the explosion in national average house prices.

Staying high despite supply

If average housing costs are reasonable by recent historical standards and there’s no apparent shortage overall, how come house prices are astronomically high?

In reality three factors determine house prices: the supply of houses, mortgage interest rates, and household incomes. In explaining the price boom of the past 20 years, only the last two have mattered. Household incomes rose quickly until the financial crisis, while interest rates have fallen dramatically over the past two decades, particularly in the wake of the crash. These huge macroeconomic forces are much more significant in determining house prices than the dysfunction of the housing market.

Obsessing about supply in this context is a bit like blaming the weight of the deckchairs for the sinking Titanic. Sure, throwing some jetsam overboard might slow things down, but it won’t solve the problem of the iceberg and the sea.

None of this is to say that we don’t have serious housing policy problems to tackle. Insufficient social housing, inadequate housing benefit, and scant protection for tenants cause misery for millions, and should be at the top of government’s agenda. We can hope that the white paper will address those distributional issues head on.

But neither these, nor stratospheric house prices, are problems that can be solved by boosting housing supply.