For decades, the British state has been hollowing itself out. Hovering around the peak of the Laffer curve, politicians struggle to get the public sector off the hook of past promises.

Across the West, people’s expectations are outpacing what the state can afford. With aging populations, excessive levels of tax, rising levels of public debt and low growth, eyes are increasingly on the bond markets.

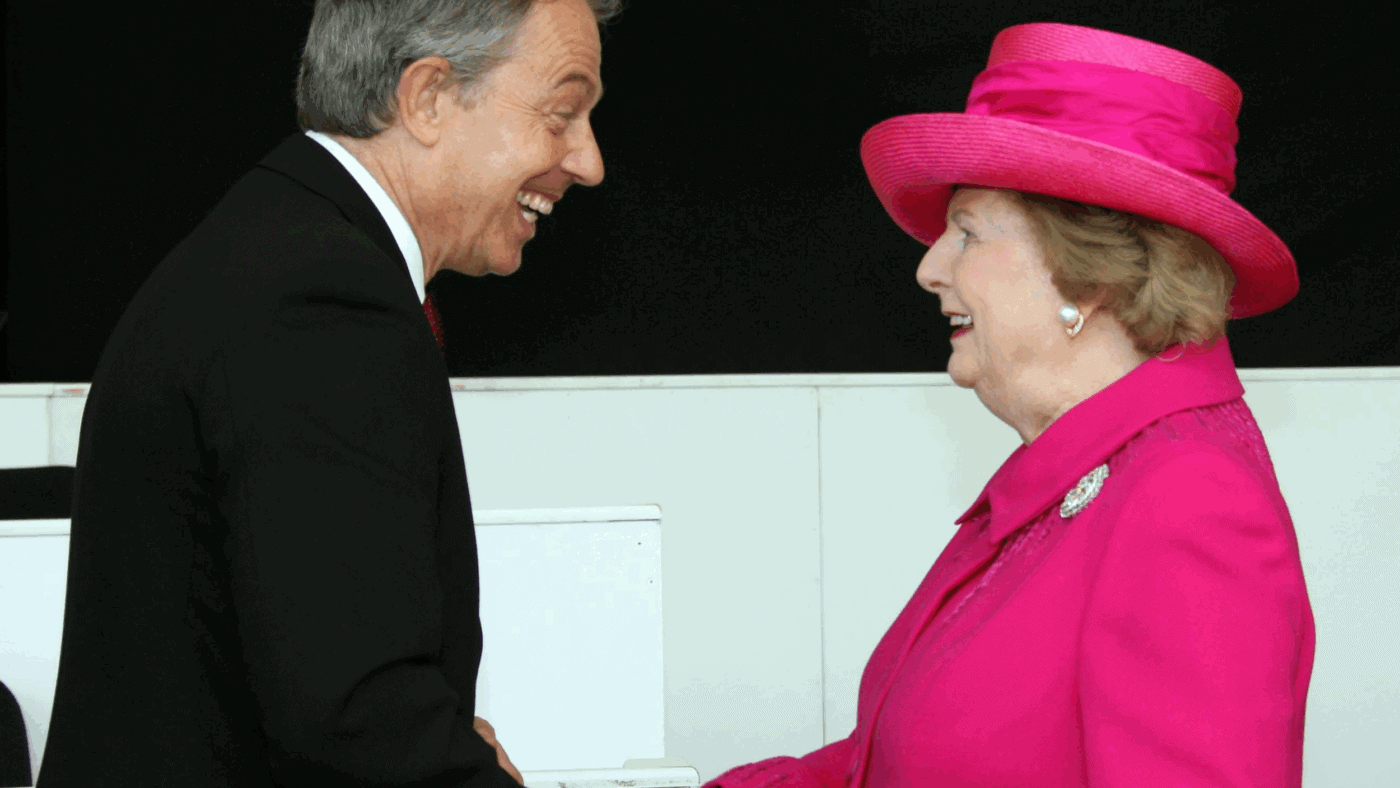

In the 1980s and early 1990s, the Conservatives were elected to open up British industry to more competitive forces. Then New Labour was trusted to modernise the human public services of health, welfare, education and policing. Throughout the Blair years, public-private partnerships abounded, but under pressure from the Left, none of the reforms went far or fast enough.

After 14 years of Tory government and now another year under Labour, increasing numbers of voters believe the two main parties remain in denial of the reforms we still need, and lack the radicalism to get a grip.

Perhaps there is no point dwelling on the mistakes of the last 15 years. The lack of supply-side reform. The endless taxing, spending and borrowing, not to mention money printing.

What does matter is that when Gordon Brown left office in 2010, Britain’s national debt was around £900 billion. When Rishi Sunak left last year, it had soared to a staggering £2.7 trillion.

Not only did the recent Tory government introduce the highest taxes in 70 years, but it adopted an endless array of central planning measures: Net Zero, mandated electric vehicles, targets for heat pumps, HS2 – you name it.

This alongside crumbling classrooms, failing prisons and police constabularies, many of whom deliver such low crime clear up rates they look like protection rackets, devoid of protection.

Perhaps worst of all, NHS waiting lists soared: from more than 4 million prior to the pandemic to more than 7.5 million in its aftermath.

Today, when vast swathes of the population are suffering the indignity of not being able to access timely surgery or treatment, the idea that they will be nudged, bullied or cajoled by ‘preventative health’ is for the birds. While Wes Streeting pours more money into the NHS and nags the public, there seems little prospect of the nation’s health improving.

Perhaps this is one reason why Nigel Farage is rarely seen without a fag and a pint, yet continues to soar in the polls. He gets it. People want more freedom, not more nannying.

As the rich leave our shores, and swathes of young talent follow, Britain has no choice. It will do what it has always done. As our government becomes bogged down in ever greater levels of state failure, the country will slowly return to its golden roots of free markets, free people, smaller government and liberty under the rule of law.

Already, the evidence is clear. People pay their taxes but to access the services they want they turn to private solutions.

In health, people pay their taxes but 7.6m people have private medical insurance. An additional 3.7m people have private health cash plans, and a further 3.3m people have private dental cover.

Around 1m people have access to private discretionary health schemes such as Benenden Healthcare. And more than 250,000 people annually self-fund for independent sector acute surgery and treatment.

Opticians and most nursing and residential care homes went private decades ago. Dentistry is now following suit.

So are GP services. Across the country, private GPs have boomed over the last five years.

Today, no politician claims that the NHS can offer ‘all dental, medical and nursing care’. After all, estimates suggest that even around half the Trades Union Congress’s membership now enjoy various forms of private health cover.

Again, there are few medical conditions or patient groups that do not have independent sector charities at their forefront. Worthy organisations such as Macmillan Cancer Support, the British Heart Foundation, Parkinson’s UK and the Alzheimer’s Society.

In education, not only do some 600,000 children attend more than 2,500 private schools but more than one in four parents regularly invest in private tuition. In recent years, more than £6bn has been annually spent on this form of private education – with more than 50% of parents reporting they would like to do the same.

Beyond privately-partnered academy schools and university tuition fees, the number of pupils now attending private schools and colleges between the ages of 16 and 18 has also soared to around 18%.

It’s the same story in law enforcement. For every state-funded policeman and woman there are more than two private sector operatives. Here, specialists range from traditional uniformed security officers to highly skilled technicians installing complex security systems.

The private sector now boasts everything from biometrics technicians, CCTV operators and close protection officers to community wardens, contract bailiffs and security dog handlers.

Elsewhere in the justice sector, privately-contracted prison services and mediation and arbitration services all play their part in a rapidly-growing market.

But, and here’s the rub, we need to go further and faster.

In social protection, retirement should be incrementally raised to 70. We need a zero-based policy approach in welfare and a rediscovery of collective self-help without the state.

In health, private medical insurance should be tax-deductible. And ISAs should be used to facilitate Singaporean-style Health Savings Accounts.

Moving forward, all health and social care provision should be in the independent sector. All investment for hospitals, homes and clinics should be set free from the Treasury.

To incentivise, empower and raise productivity, a French-style social insurance model should be adopted.

Then would come professional de-monopolisation and a transition from state regulation to consumer-led standards and the establishment of trusted brands to overcome information asymmetries through commercial free speech.

To encourage transparency, all legal health and pharmaceutical goods and services should be opened to advertising, so that people are empowered to make more informed choices.

In education, private schooling should be tax-deductible. For pupils aged between four and 18, there should also be universal access to school vouchers and all school provision should be in the independent sector.

Again, all institutions of higher education should be set free to establish their own fees and financial services arrangements for their customers.

In transport, Britain needs a full-blown Japanese-style private railway. It also needs motorway privatisation, road pricing and more private airports. Only then will investment and supply meet the expectations of demand.

In housing and planning, the 1947 Town and Country Planning Act should be scrapped. The country should return to a planning system built on private property rights and the common law.

Where the state does need to intervene, a French-style compulsory purchase order system should be considered. Here, the state pays twice the value of any land purchased, incentivising building and growth.

On inflation and debt, the Bank of England should be mandated to focus on zero inflation through sound money.

All of this is necessary to sustainably rebalance our economy. To turbo-charge growth, taxes must be reduced and the state refocused.

In many ways, people are way ahead of the politicians. There is no great political realignment. Instead, there is what there has always been. An underlying belief in free people, enterprise, trade and the rule of law.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.