I’ve never really understood the point of a think tank launching a commission full of high profile entrepreneurs, politicians, and trade unionists. To start with they tend to be rather dull. High-profile and time-poor individuals don’t back new ideas.

Worse, these commissions tend to get dominated by the most politically active members with hobby horses. From an organisational perspective, they’re a pain. You have to get half a dozen people to sign-off on it and you still end up writing the thing yourself.

The one thing they have going for them is that they tend to get a lot of (I’d argue undeserved) press attention and influence. The Institute for Public Policy Research’s Commission on Economic Justice is no exception. The ideas aren’t new and they won’t solve any of the real problems with the UK economy.

It’s true that, as the report’s authors claim, productivity isn’t growing as fast as it historically has and that for the average worker living standards have stagnated. But the IPPR are focused on the wrong causes and ignore the real problems. They blame our weak economic performance on five main factors. Let’s look at them in turn.

Businesses are under-investing because they’re only focused on increasing shareholder value in the short-term

This argument is deceptively attractive, but it relies on rejecting a core economic fact: investors want to make money. A firm’s share price reflects not only it’s current profitability but it’s future profitability too. Take Amazon – it’s only the second company to get a trillion-dollar valuation but in 2017 its price-to-earnings ratio was 511 (by contrast Apple’s was 13). In other words, investors patiently allowed Amazon to aggressively invest in expansion at the expense of short-term profitability because they knew that in the long run those investments would pay off.

For the IPPR’s claim about short-termism to be true, shares would have to be systematically misvalued. Any would-be investor could come in and make money simply by being a little bit more long-term. One of the great things about markets is they reward people who provide better information. If shares were overvalued, the report’s author could bet against further growth and profit. The fact they don’t is a good reason to be sceptical.

As evidence, the IPPR point to a recent rise in stock buybacks. But this misunderstands the point of buybacks. A firm simply can’t pump up its share price by buying back stock.

As legendary investor Cliff Asness points out: “The idea is that by repurchasing shares, a company decreases its share count and thus mechanically increases its earnings per share. The problem with this argument is that it ignores the fact that decreased cash means lower earnings, either due to less interest earned on the cash or the loss of returns from other uses of the cash.”

Buybacks don’t explain under-investment either. When firms buy back stock the investors they buy it from don’t simply burn it. They use the funds to invest in other companies with more profitable opportunities.

It’s hard to test the idea that public markets are simply too short-termist, but venture capitalists are almost certainly not short-termist. They make investments and might not see a return for five,10, or even 20 years. If markets are short-term, we’d expect long-term investors to outperform the market. But they don’t.

Sterling is overvalued and it has caused the decline of manufacturing

At this point the IPPR start singing from the same hymn sheet as the “£ Campaign” (coincidentally the £ Campaign’s founder Importer-Exporter John Mills is also a commissioner for the report). In their view, the success of the UK’s financial sector and the attractiveness of British assets has inflated the value of sterling at the expense of manufacturing. The problem is that devaluing sterling can only ever be a short-term shot in the arm for exporters at the expense of importers. As University of Durham Banking Professor Kevin Dowd points out, if repeated or sustained devaluation boosted exports then “Argentina would be a role model”.

Flexible labour markets are leading firms to under-invest in their workers

The IPPR seem to believe low pay causes low productivity. It doesn’t; in fact, the inverse is true. Low productivity causes low pay! It might seem plausible that firms will under-invest in new tools or training if they have a ready supply of cheap labour, but this fails to understand how productivity actually grows.

As Swedish labour economist Magnus Henrekson points out: “Economic growth is not primarily about firms growing by a similar percentage or productivity rising in existing jobs because of technological change and more capital per worker. Rather, it comes mainly from churning (firm and job turnover) and restructuring — mostly shifts in production from less to more successful firms”.

He finds a strong negative correlation between the strictness of labour market regulations and the proportion of the working-age population involved in high growth early-stage entrepreneurship.

Businesses aren’t adopting new tech at a fast enough rate

Perhaps the IPPR are right here, but one of the key reasons we have a market economy (as opposed to a centrally planned one) is that government is poorly placed to determine whether or not small firms are making the right or wrong investments. Recent history suggests government rarely picks winners, it usually subsidises losers. What do the IPPR know that small business owners don’t?

Markets are too concentrated

While there perhaps ought to be a debate on the purpose of competition policy, it would help if the IPPR knew what they were talking about. They wrongly assume that competition authorities are ill-equipped to handle cases dealing with social media and online search engines because they only assess cases on short-term price effects. Love it or loathe it, the European Commission’s Google ruling shows that the IPPR are simply wrong here.

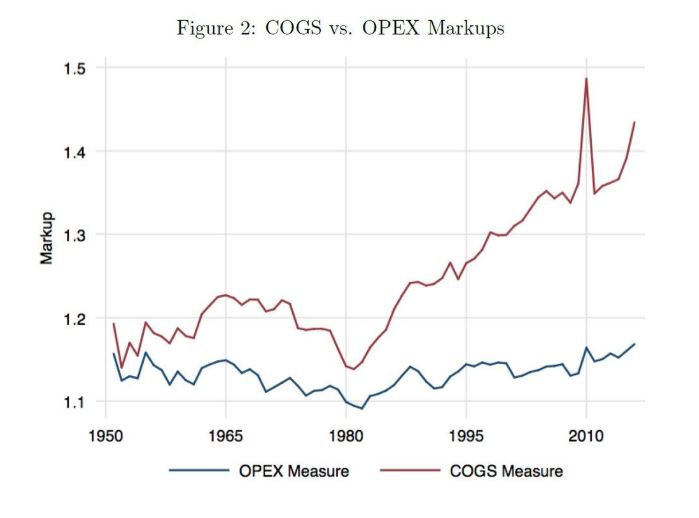

They rely too on a recent study finding that markups are on the rise. But this study doesn’t necessarily imply that markets are uncompetitive. Markups are only increasing if you compare prices with the cost of producing each additional unit. If you include overheads and fixed costs such as R&D and marketing, then markups aren’t increasing at all. The real story is that we’re moving to an economy where intangibles matter more.

By starting from faulty premises, they end up drawing faulty conclusions. They advocate a more activist state, tougher regulation and more quangos handing out grants. In fact, according to the Centre for Policy Studies’ Tom Clougherty, they call for the creation of at least 15 new quangos. This reflex to set up a new government body to solve every problem is a hallmark of an unoriginal, timid report.

They don’t address the real problems in the economy. The biggest drag on the UK’s productivity, and the reason wealth inequality is now rising, is housing. Yet, the measures proposed in the report would do little to boost supply. They ignore the Green Belt and the need for radical planning liberalisation. Allowing more market rate construction would bring down housing costs and make it easier for workers in the least productive places move to where they are most productive.

They worry too about under-investment but are confused on whether they want a more pro-investment tax system. In the space of two paragraphs they call for more investment allowances and fewer depreciation write-offs — giving with one hand and taking with the other. Beyond planning reform, the best thing the UK could do to boost growth and productivity would be to allow firms to immediately write-off new investments as the US has recently temporarily done. Multiple studies have found this reform boosts wages, job growth, and output.

Fundamentally, it is their focus on pre-distribution (opposed to redistribution) that leads them to ignore the most important reforms. It’s my view that the role of policy is to maximise wealth creation and then redistribute some of it to the less well-off so that they can enjoy good lives too. The IPPR instead care more about means and intentions than they do ends and outcomes, prioritising feel-good policies even if they make us less well off in the end.