Jeremy Corbyn and John McDonnell fought the last election on a promise to implement a mass programme of nationalisation. And that very much remains their plan. The energy, water, rail and mail sectors, as well as some PFI deals, will be first on the list of areas that Labour would seek to bring back into government ownership.

Other sectors could follow. An official document entitled Alternative Models of Ownership, which was published for the Shadow Chancellor after the general election, mentions infrastructure, telecommunications and the digital economy as areas that would function better outside of private ownership.

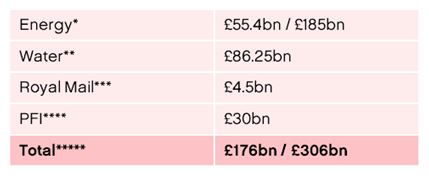

But even their manifesto commitments alone are enough to cause British taxpayers considerable concern. Labour has so far refused to cost their plans, and it is easy to see why. Based on commercial values, the upfront cost associated with these pledges is simply staggering. As I have calculated in my report for the Centre For Policy Studies, The Costs of Nationalisation, Labour’s manifesto commitments on nationalisation would mean a £176bn bill for the taxpayer (see Table 1). That is equivalent to 10.1 per cent of the national debt, or nearly £6,500 for each household.

Incidentally, this figure assumes that, in the case of the energy sector, Labour would only nationalise the transmission and distribution networks. If Corbyn went further and took ownership of the whole energy industry, the overall cost could rise to over £300bn.

These estimates, of course, only relate to upfront capital costs. There would also be a series of ongoing costs in all of the industries concerned that would become the responsibility of the government, not to mention all of the pension liabilities.

Table 1: Upfront cost of Labour’s nationalisation plans over one parliamentary term (exc rail). Source: The Cost of Nationalisation, Centre for Policy Studies

Borrowing such large sums of money to pay for nationalisation is risky in itself. But just think about the opportunity cost. £176bn could theoretically be used to build 2.93m council homes or fund the defence equipment budget for 19 years.

Corbyn and McDonnell claim that this expensive risk is worth it. They justify their proposed nationalisation programme on the basis that it would save households £220 a year. But no one knows how this can be squared with the costs of borrowing and the probable decline in industry efficiency. The water companies, for example, are now 64 per cent more productive than they were under state control. Moreover, privately owned electricity distributors in Australia operate their assets between 15-33 per cent more cheaply than equivalent assets that are in government ownership. Incidentally, that is far higher than the returns investors receive in UK energy networks.

And by locking out private capital from these sectors, there will be an increase in the competition for capital in the public sector. This could lead to the industries being neglected (as has happened historically), or resources being diverted from other priority areas.

The upfront cost of Labour’s nationalisation programme is important to know, given that their current plan is to simply pay below the commercial price of assets. On The Andrew Marr Show on Sunday, McDonnell argued that “it is for Parliament to decide the price”. Would this sinister suggestion save on costs?

Well, not in the medium to long-term. Going down this route could have enormous implications.

Seizure of assets below their commercial value would dampen business confidence, potentially leading to huge job losses. Investors could become fearful of further non-voluntary purchases of private businesses or the introduction of regulatory rules that would damage the competitiveness of UK industry. Moreover, confidence in the government would likely collapse (leading to even more upward pressure on borrowing costs for Labour’s other planned spending) and pension funds that have invested heavily in utilities would suffer losses (Labour has talked about “differential” compensation rates, but this would undoubtedly be challenged in the Courts). This could explain why John McDonnell is planning for a run on the pound if Labour is elected to power.

While there are substantial costs and risks associated with nationalising the utilities, there is little evidence to suggest that consumers have anything to gain – despite Labour’s claim otherwise. UK domestic electricity prices, for example, are roughly average for Europe, and consumers in Ireland and Germany – where there is a high degree of government ownership in the energy sector – pay higher prices than those in the UK. Furthermore, water bills under the current system are set to fall over the coming decade.

This is not to say that these industries are faultless. They certainly are not. But many of the issues that do exist relate to a lack of adequate competitive pressures. Labour’s solution would simply exacerbate existing problems, while costing the taxpayer an enormous sum of money and causing wider macroeconomic instability.

Over the next week, I will publish a series of articles for CapX examining the key sectors that Labour plans to nationalise, explaining in further detail what Corbyn is planning, what the risks are, why nationalisation is the wrong solution, and what actions should be taken instead.