Last night, I appeared on Newsnight to discuss the renationalisation of the water industry. It was a depressing experience, because my debating partner – from the trade union think tank CLASS – seemed utterly impervious to anything resembling the facts.

In particular, there is a weird tendency on the left to assume that we free-market types view the current privatised regime as the best of all possible worlds.

In fact, no one is saying that the privatised water industry is perfect, or even close. In fact the most brutal demolition of industry bad practice came from… Michael Gove, in a speech to the water industry (the Environment Secretary equivalent of Theresa May at the Policy Federation.)

But there are two key questions to ask: are things better now under private management/ownership? And would they be better in future under nationalised ownership?

On the first question, the answer is a resounding yes. As we spelt out in our report The Cost of Nationalisation, leaks are down by a third, supply interruptions down fivefold, we have much cleaner water and much, much cleaner beaches.

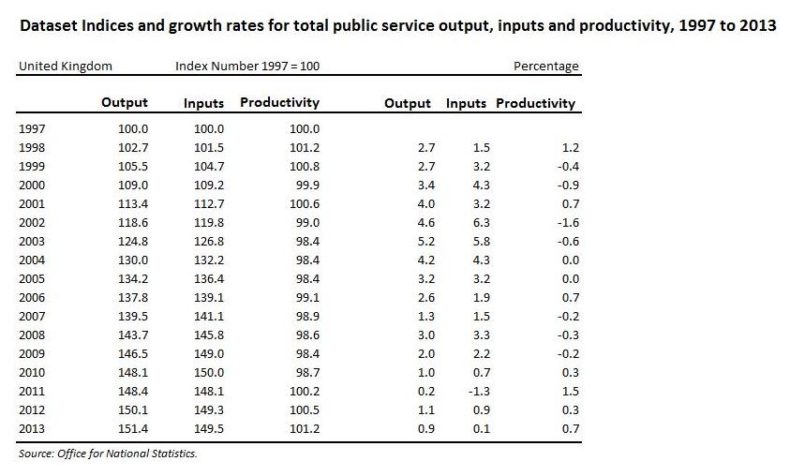

In particular, productivity in the privatised water sector is up 64 per cent since nationalisation — versus approximately 30 per cent in comparable sectors, and pretty much zero (shockingly) in the public sector as a whole.

(In fact, there’s a wider argument against nationalisation here. Between 1997 and 2013, every improvement in public sector performance (to a rough approximation) was achieved by spending more money, not doing things better. It’s the productivity problem no one talks about.)

What about higher bills, I hear you say. What about all those leaks? What about the 1,249 Olympic swimming pools that are wasted every single day?

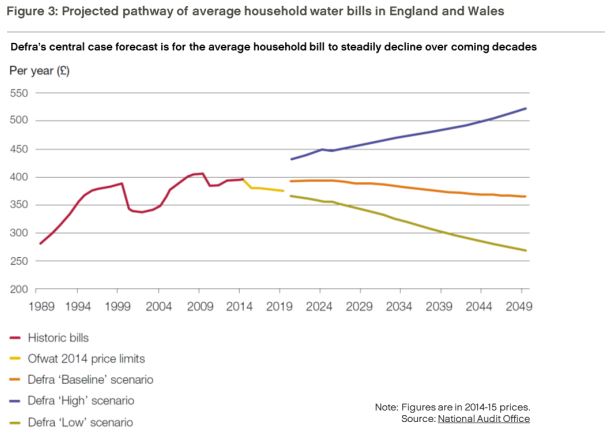

Yes, bills have risen significantly in real terms. But that’s because, under public sector ownership, the water industry was starved of investment. Victorian sewers, reservoirs and pipes were left to crumble. The rise in bills rise reflects the enormous backlog of investment that was needed – and bills are now, on Ofwat’s central estimate, set to come down.

As for leaks, it’s actually Ofwat – i.e. the government regulator – that determines whether a leak is fixed. And they say it should only be done if it’s cheaper to fix it than to leave it (what is known as “the sustainable economic level of leakage”, which also considers the wider impact on supply and the environment). Ofwat sets the targets, not the companies.

But what about the hideous profits made by the water companies? And their CEOs’ salaries? Every drop of profit means higher costs for us poor consumers. This is a monopoly, not a market. Why should they make profits at all?

It’s true that water isn’t a market – it’s a regulated monopoly. And, as Michael Gove argued, some water firms have pushed things to the limit and beyond – corporate structures based in the Cayman Islands, loading up on debt in order to maximise their profits. But overall, the profits they can make are set by Ofwat – and governed largely by how much investment they put in. We still pay around a penny per litre for water. It’s not a bad deal. And the profits are the price for that higher productivity.

The water firms aren’t perfect, by any means. But Ofwat and Gove have very big sticks to beat them with, and are giving themselves bigger sticks still: Thames Water has been fined £110m and counting for leaks, and leak targets are being toughened massively.

What about the second key question? Would it make sense to nationalise this vital national resource?

In terms of the benefits of nationalisation, there are two key issues. The first is the upfront borrowing cost. As The Cost of Nationalisation showed, the market value of the water firms is approximately £86bn. (A separate estimate by another think tank, the Social Market Foundation, put it at £90bn.)

Either you add that to borrowing – increasing the national debt by roughly 5 per cent, or £3,000 per household – or, as John McDonnell says, you set the price yourself. But that would make Britain a place where assets can be appropriated by the state, which is a surefire way to send investors running to the hills. That would mean a drastic shortage of people willing to fund our infrastructure spending and huge losses for British pensioners, who own big chunks of these firms via pension funds.

But wait, chant the Corbynistas, it’s not a cost – an asset is created. The borrowing pays for itself.

Yes, but working out whether revenues pay for the borrowing requires you to assume that borrowing costs don’t rise under Labour (generous), and that the industry will be run in exactly the same way (ludicrously implausible).

This is without considering the industry’s £49bn debts, which some reports say would have to be repaid immediately upon nationalisation.

The really big issue, though, is the ongoing cost. The National Infrastructure Commission says that to cope with climate change-driven weather volatility (like this summer, some would say), we need to cut leaks by 50 per cent. That can’t happen by magic. It requires billions and billions to be spent on new pipes, sewers and reservoirs.

The current spending plan is for £100bn to be spent on improving our water infrastructure over the next 25 years. Add that to public capital spending, and it’s a big-ticket item – almost as much as is set aside for NHS.

Within public ownership, the water industry is in competition with all the Government’s other priorities for spending. This was precisely the problem in the 1970s – it always lost out. Hence the crumbling pipes.

But in fact, we don’t even need to look at the 1970s. Northern Ireland water is publicly owned/operated. It submitted its infrastructure plan in 2015. Government said we haven’t got the money. So the work isn’t being done.

In short, the choice for water isn’t between a perfect nationalised system and awful private system, or vice versa. It’s between two real-world options.

Whatever we do, water will need billions in infrastructure spending. Private ownership, and the big stick wielded by the regulators, guarantees that stream of investment – and productivity improvements help keep costs to punters down. That’s not to say the system is perfect: there are all kinds of changes I’d like to see, not least the increased retail competition called for by Ofwat, which, unlike Labour’s natoinalisation plans, would offer a clear route to cutting customers’ bills.

Public ownership, on the other hand, involves massive upfront borrowing, then significant ongoing costs, with no guarantee that government after government will pay them. And given the industry’s likely productivity performance, it means the costs will be loaded on to the taxpayer, either by higher taxes, higher bills or higher borrowing.

In short, privatisation is imperfect. But there is pretty much no solid evidence – certainly not from Labour – for how nationalisation fixes its problems or lowers bills for consumers — or even stops the leaks.