In the end, the big story of the Autumn Statement was really about debt — some £2 trillion of it by the end of the Parliament, peaking at over 90 per cent of GDP.

George Osborne barely ever met his deficit reduction or debt targets, and wasn’t going to meet the final ones he announced anyway. But it’s still a bit jarring to see the good folk at the Treasury go this high.

Aside from anything else, that will take UK debt into that above-85 per cent of GDP region which multiple economic studies have suggested is associated with lower GDP growth. (Remember Reinhart and Rogoff? Well, I don’t mean them – the result they were famous for “getting wrong” had been around for decades before their version of it was published.)

A fair chunk of the debt increase is the usual combination of public spending not quite dropping as desired, growth not being quite so fast, and not quite as much tax coming in for any given amount of growth.

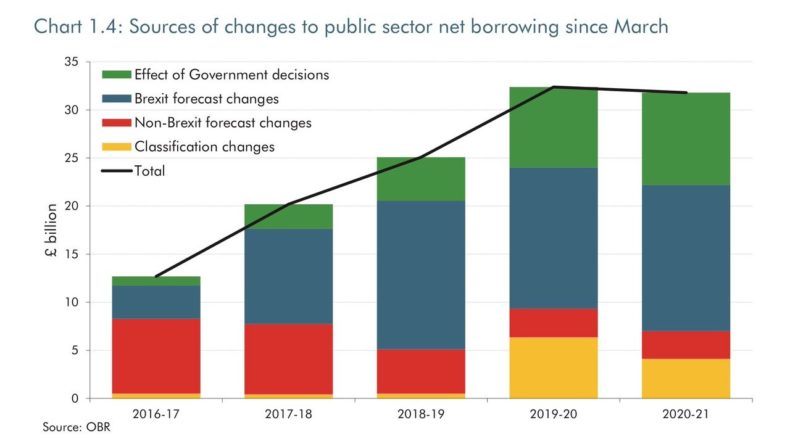

But, of course, a good chunk of it is Brexit-related. The OBR even provided us with a handy chart:

The OBR reckons that in the period to 2021, borrowing will be £58.6 billion higher due to Brexit.

Of that, more than a quarter arises because the OBR reckons the Brexit vote and then actually leaving the EU will allow the Government to exercise more control over immigration (still without actually meeting its own target to get it down to the “tens of thousands”).

Nearly a third is the result of Brexit-related lower productivity growth. And around 45 per cent is the result of a temporary Brexit-related cyclical slowdown (i.e. stuff we’ll get back later).

The OBR’s growth revisions are actually fairly modest — perhaps even a little less than I might have argued for.

It expects growth in potential output to be around 2 per cent per annum from 2020 onwards (only a smidgeon down from its previous view), with a bit more lost in 2017 and 2018 (at 18 per cent), when it appears to expect most of the Brexit impacts to occur.

The total GDP loss from Brexit is 2.4 per cent. During the referendum I said I expected Brexit to lead to a short-term loss of 2-3 per cent of GDP, mainly concentrated in the years 2019-2021.

I now think 2018-2020 is, perhaps, the key period (so I’m only one year different from the OBR) – but recent EU posturing over “punishing” the UK means I might be drifting nearer the top end of my 2-3 per cent range, while the OBR is bang in the middle. We’ll see.

In the short term, I expect growth of 1.7 per cent in 2017, while the OBR is a bit lower, but we’re roughly in the same ball park. It all looks pretty sensible to me. Indeed, the OBR forecasts GDP growth from 2015 to 2021, in percentage terms, as follows: 2.2, 2.1, 1.4, 1.7, 2.1, 2.1, 2.0.

If that’s all Brexit does to the economy in the next five years, I reckon most voters will think: “Is that it? What was all the fuss about?”

As for the Chancellor’s speech, he didn’t announce any great fiscal splurge – thank goodness. Just a bit of “National Productivity Investment Fund” spending, mainly on housing and R&D. We’ll see whether Hammond’s housing schemes turn into actual extra houses any better than Osborne’s did (or didn’t).

One interesting point is that the Chancellor’s speech did not use the terms “green” or “climate change” at all. The only mention of “carbon” was to tell us that Carbon Price Support will be capped to 2020 to help out the oil and gas sector – and the main green tax rise announcement was that there wouldn’t be one on fuel duty.

In other words, there are no votes in sacrificing the economy to help the environment any more. It’s all “infrastructure” and “resilience” nowadays.

Overall, in my view this was a perfectly sensible statement at this point. All very “no need to panic, we’ve got this”.

Some time up ahead there will need to be extra spending cuts again, but we can save that debate for another day. Resilience it is.