This week on CapX we are publishing the winning entry and the runners-up for the Institute of Economic Affairs Breakthrough Prize. The prize, supported by entrepreneur Richard Koch, sought ideas for a “free market breakthrough” policy to solve the UK housing crisis. Today, Charles Shaw and Daniel Pycock argue that a new system of Simplified Planning Zones would cut through the bureaucracy that keeps Britain’s house prices unaffordably high for so many.

The UK is notable for its complex planning regime focused on urban containment. This it achieves with the development control framework established by the Town and Country Planning Act, which is enforced by local authorities using development plans, ‘greenbelt’ designations, recursive height and density restrictions, and protected views schemes. Against this backdrop, a key long-term political concern is the lack of affordable dwellings for purchase or rent. As a result, UK house prices are extraordinarily high, and housing in London and the South East of England is some of the most expensive and cramped in the world.

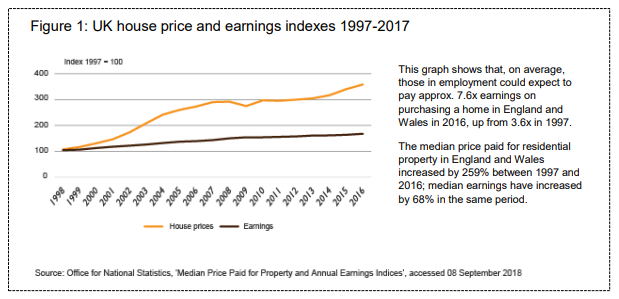

Internationally, a ‘comparable apartment’ in London trails only Hong Kong and Monaco in price, and Hong Kong and Bermuda in rents. Yet housing costs are also high when measured relative to income. A standard measure of affordability is the ratio of median house price to median annual full time earnings (Figures 2 and 3). In fifteen years, that ratio has increased from 5.06 to 7.78 in England and Wales, and 6.38 to 10.26 in South East England. In London, where affordability is at its worst since records began, the ratio has grown from 6.57 to 12.36 while median rent to income has climbed from 1:5 to 1:3.

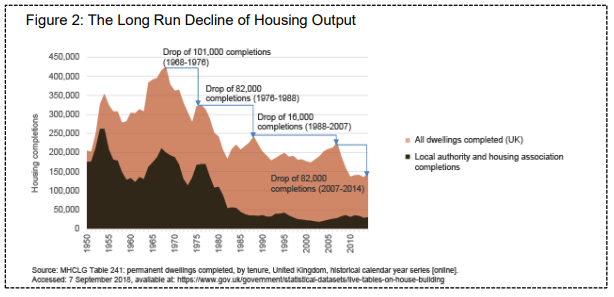

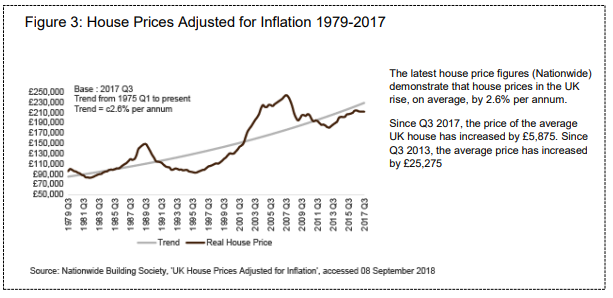

This current lack of housing affordability has not developed overnight (Figure 1). The value of UK housing stock has increased by more than a third in the past decade. In fact, UK house prices have grown faster than in any other OECD country over the last four decades. They have also strongly outperformed real GDP per capita growth. However, UK house prices are also extremely volatile. As demonstrated by Hilber and Vermeulen, volatility in real UK house prices is significantly higher than the most volatile areas of the United States. The cause of this is the decline in per capita terms housebuilding since the 1970s, as well as the concomitant “lack of supply responsiveness to changes in demand” identified by Barker.

For the period 1967 to 1991, the UK built approximately 5.7 million new-build dwellings during which the population increased by 4.5%, or 2.5 million people. For the period 1991 to 2016, the UK built just over 3.5 million dwellings with population growth of 14.3%, or 8.2 million people. Taking into account factors such as densification, this implies a shortfall of at least three million housing units before considering the ongoing deficit between housing starts and population growth. The average market participant, then, lives in artificially cramped housing and is priced out from upsizing. In the meantime, the young and highly-skilled are displaced into suboptimal living arrangements by ever increasing rents.

This is an important point not least because since 2011, spatial misallocation has limited the number of those working in London’s scientific, technological, engineering, research and other sectors. This hurts the capital’s productivity, and is estimated to have reduced aggregate UK GDP by between 13 and 30%. On the margins of market clearing meanwhile, there are those who approach but never

quite surpass the deposit requirements to purchase their first home. But what has caused the decline in housebuilding identified? From a production perspective, the factor of land has increased in price from 50% to 200% of GDP in the last fifty years. To dig deeper, however, we need to look at the planning system.

How the planning system works

The first stage of the planning system arises from land use regulations of the Town and Country Planning (Use Classes) Order, which prescribes and designates categories for land use. If an individual plans to convert a commercial premises or farmland to housing, they first require permission related to land use.

The building plans are then submitted to the local planning authority (“LPA”), who “assess the plan to ensure it is in keeping with development plans, existing infrastructure, permitted use, dimensions and materials as appropriate to the area” and reach a decision. If the decision is objected to, it can be appealed firstly to the Planning Inspectorate, and ultimately, to the Secretary of State for Housing, Communities and Local Government.

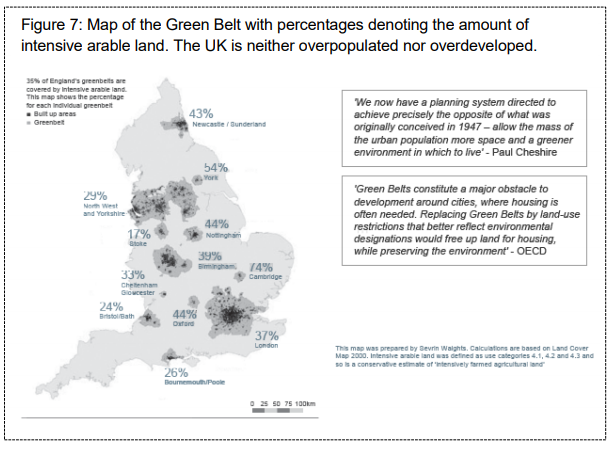

Yet there are many problems with how this system works in practice. In economic terms, we know that the restriction of land supply is a key factor. There is an unavoidable aspect to this, including the prohibitive cost of developing “brownfield” sites and the infeasibility of building on certain topographies. Yet there is also an aspect of it that is unnecessary and artificial. A study of the distribution of greenbelt designation, for instance, would show that the inclination of an LPA to protect undeveloped land with “green-belt” designation is positively correlated with the acuteness of local housing need. Assuming the obstacle of land-use has been overcome in the design stage, however, there are then the hurdles to acquiring planning permission for the development itself.

One hurdle could include, for instance, the objections of local residents. Another could be section 106 obligations. The largest hurdle, however, is the uncertainty of outcome from the planning committee(s) of the LPA(s) themselves. The evidence shows that the proportion of planning applications rejected by LPAs is again positively correlated to the acuteness of housing need. Hilber and Vermeulen moreover

have shown that regulatory constraints were responsible for over half of the increase in UK house prices between 1974 and 2008. This means not only that UK house prices would be 35% lower had the planning system been abolished, but also that South East of England house prices would be 25% lower if it had the regulatory restrictiveness (or lack thereof) of the North East.

But what is behind this regional reticence? Well, a lack of incentives for one. There are no incentives for local authorities to approve residential development. Under the current arrangements, local authorities are funded by fees, local taxes, and central government grants – the formulae of which offset any medium-term gains by expanding the council tax base. The cost of infrastructure for residential developments is, moreover, borne by local authorities, which means that developments become a net loss. This empowers the “NIMBY” representations made by local residents (often acting rationally by protecting the value of their housing investment), with which LPA officers are often inclined to concur. All of these factors mean that the planning system is arguably responsible for 70% of the increase in UK house prices since the 1970s. The planning system is the foremost factor to look at.

Other problems with the housing market

There are multiple problems with the housing market, notwithstanding the negative effects of the planning system. Perhaps the most obvious is a lack of political leadership. This is represented concisely by the fact that Kit Malthouse, Minister of State for Housing since July, is the seventeenth occupant of that office in two decades.

Then there are further aspects of the planning system, such as Section 106 of the Town and Country Planning Act (1990) that places an obligation on residential developers to allocate a percentage to ‘affordable housing’. This is negotiated with the local planning authority; the outcome is uncertain and unknown until very late in the process, and this means that developers can only estimate land prices and secure working capital for the project at the last minute.

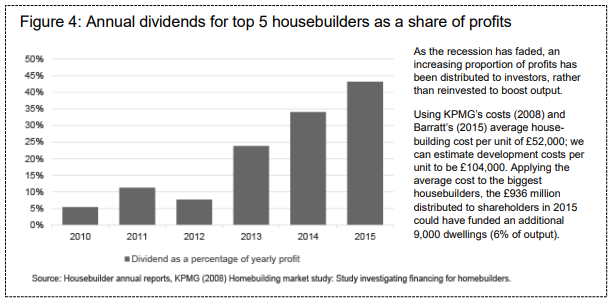

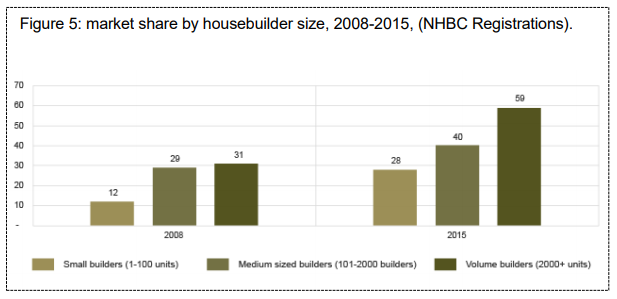

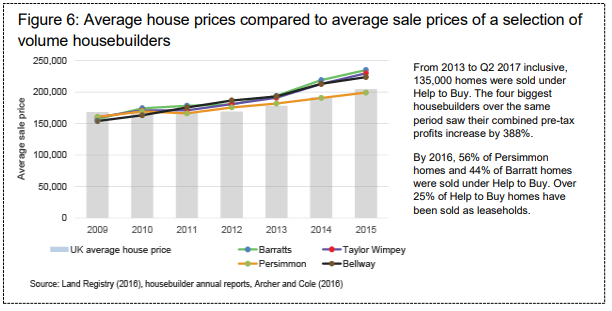

This is particularly onerous for small housebuilding firms, and constitutes a significant barrier to entry. This partly explains the trend of high-volume builders growing from 31% market share (2008) to over 60% now, and is why the House of Lords concluded the market had “all the characteristics of an oligopoly” (Figures 4, 5, 6). In such circumstances, the Lords continue, “it is rational for private enterprise to optimise profits rather than volume, [and to limit] their uncertainty in a market characterised by constant Government intervention and cyclical risk’. The future, if industry consolidation is not tackled, is one of contrived scarcity to maximise profitability per unit over volume, and competitors lacking access to finance and land. Yet this is not all.

There are also government policies, often implemented with the intention of alleviating the housing affordability crisis, that have in fact made matters worse. One example is the “Right to Buy”, introduced in the Housing Act 1980. This policy gives select social housing tenants the option to purchase their home at a materially subsidised price. This constrains housing supply because local authorities and housing associations cannot replace housing units with partial compensation and as elucidated by Hilber and Robert-Nicoud, a converted homeowner is more likely to oppose new construction than a tenant would. Then there is also “Help to Buy”.

This was introduced in 2013 to improve the balance sheet of borrowers and to stimulate housing demand. The scheme consisted of multiple options, the most generous of which allowed aspiring owners to purchase a new-build home with a 5% deposit. Such housing subsidies as these have perverse effects. When housing markets are tightly regulated and where there is inflexible supply, subsidies have the effect of reducing homeownership. The Government has long argued for such schemes due to their potential ability to reduce risk of household income exposure to house prices. Yet Benetton et al. show that these were predominantly used by households to buy properties they would otherwise not have been able to afford. Hence contrary to stated objectives, “Help to Buy” improved neither borrowers balance sheets nor household risk exposure.

Suggested policy response

The UK requires a programme of housebuilding that in scale is analogous to the 1950s, where then Minister for Housing and Local Government Harold MacMillan was tasked with building 300,000 homes per-annum. It requires the volume of construction achieved by the New Town Corporations of the 1960s executed with the market nous of the London Docklands Development Corporation in the 1980s. The current target for new dwellings of 300,000 per-annum is inadequate and should be increased to 500,000 to account for the historical undersupply. Development ought to be driven by private-sector financing under a demand-led planning regime. In terms of oversight, there is an argument for taking responsibility away from a government office subject to ministerial carousel, and giving it to an independent body. This could be called the National Housing Commission – and its remit could be to determine and drive policy through evidence and reason.

Yet such suggestions in themselves are not policies. Moreover, it is important to highlight the fact that if there were a “silver bullet” policy that would increase homeownership and be politically feasible, such a policy would have been included in respective manifestos either by “Orange Book” Liberal Democrats or by free-market Conservatives. There can, therefore, only be multiple policies to improve the number of houses built and the rate of homeownership. This essay recommends a three-pronged policy response to alleviate the housing shortage and rejuvenate our property-owning democracy. When analysed alone, these recommendations would be necessary but not sufficient. If implemented in a mutually reinforcing way, however, they would lead to a material process of conversion and change.

The first recommendation is a simplification of the planning process. This can be achieved effectively by eliminating “development control” and instituting a rules based and market oriented zoning system. The implementation of this would be feasible through Simplified Planning Zone (“SPZ”) pilot schemes in certain local authorities, to be followed by a roll-out across the country. This would ensure the efficient allocation of land and a simplified

planning process with higher outcome certainty. This would alleviate the artificial scarcity of land, and remove the need to acquire planning permission for any change of land-use.

Instead, certain areas would be marked for residential use and – within those zones – there would be an automatic presumption of development. The objections of neighbours could only proceed if the developer is in articulable breach of building regulations. This would remove the need for lengthy public consultations and also eliminate negotiations for Section 106, thereby alleviating delays that hit the largest developments and smallest housebuilding firms hardest, and invigorating supply-side market competitiveness.

The second recommendation, which is conditional on the pilot scheme phase of the first, is that the central government oblige local authorities to critically review their designated green belts, height/density restrictions, “protected view” corridors and other planning constraints for market failure.

This can be implemented either by government circular, or through inclusion in the National Planning Policy Framework. Where areas of market failure are identified, and development could reasonably be argued to exceed opportunity costs, the government should then consider imposing a Simplified Planning Zone. This should especially be the case in London, where a relaxation of the Metropolitan Green Belt by just 5% would be enough for over 1 million new homes at unambitious densities within 15 minutes’ walk of an existing tube or train station (Figure 7).

The third and final recommendation is to reintroduce fiscal incentives at local level for permitting development. This would aim to stimulate housebuilding outside of Simplified Planning Zone areas by aligning local tax revenues per capita to residential development. This would incentivise LPAs not only to approve more good planning applications, but also to encourage them and improve them, even under a development control framework. In nearly all cases in the UK, there are no such incentives currently in place. The only local tax is based on (outdated) property value and, compared internationally, it is irrelevant to the UK tax framework. As such, the Mirrlees Review recommended it ought to have more weight. This essay endorses the Mirrlees proposals.

This essay further advises that such proposals could be implemented in a revenue-neutral way either by adjusting the formulae with which central government grants are awarded, by the introduction of a residential development precept on new-builds, or by the introduction of a value added tax on housing consumption. This would give councils full control over their council tax revenues and prevent central government from offsetting extra revenue in the medium-term against the funding given to councils by grant. This scheme should be run alongside the initiative proposed by Bosetti and Sims to train councillors and officers such that they have the expertise to confidently guide developers towards high-quality development.

The state of the housing market going forward needs to include the elimination of each demand-side (e.g. “Right to Buy”, “Help to Buy”) and supply-side (e.g. Starter Homes Land Fund) subsidy. It needs to see a reinvigoration of competitiveness on the supplyside and the removal of unhelpful barriers and regulations that get in the way of building homes. It might be more efficient, for instance, to see a fairly uniform densification of existing urban areas; the transformation of brownfield sites into urban green space and for construction to take place on a small percentage of the green belt. The core argument of this essay, however, is that we can and have to find a feasible and Pareto-improving way of reforming the planning system. This is because housing is highly income elastic and therefore the improvement of affordability is almost entirely dependent on supply.

With incentives and training for local authorities to encourage development on the one hand, and Simplified Planning Zones on the other, we believe we have struck the right balance to enable housebuilders to build, for house prices to gradually adjust in a more competitive market, for housing affordability to improve relative to income, and therefore for homeownership to increase.