“The top 5%, yes they will pay a bit more…because we believe those with the broadest shoulders should carry the most weight.” That was Shadow Chancellor John McDonnell on Sunday’s edition of the Andrew Marr Show.

The problem is, his claim that only the rich will fund what the Institute of Fiscal Studies has called Labour’s ‘colossal’ spending plans is more than just misleading – it’s completely untrue.

A detailed analysis of the tax increases hidden in the party’s manifesto – and how they relate to small businesses – disproves Labour’s ‘pledge’ that only those earning more than £80,000 stand to lose out from their proposals.

Just look at self-employed people operating as limited companies, who stand to pay as much as 45% more tax under John McDonnell’s plans.

There are more than five million small businesses in the UK, often comprising one person – people like electricians, plumbers, hairdressers and many IT professionals.

Many of them will be hit by McDonnell’s plan to raise corporation tax to 21%, compared to the current 19%, and start to tax dividends at the same rate as income from general employment.

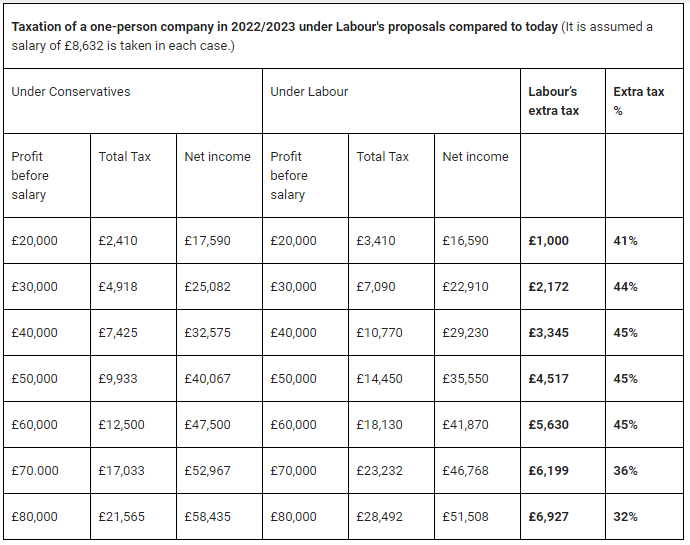

The figures in the table below show what this actually means and how much of the tax burden would actually fall on middle-income earners.

Someone whose business has a gross profit of £30,000 would pay an extra £2,172 in tax, while someone with a gross profit of £50,000 would be down £4,517. Most of the increase is caused by Labour’s plan to hike the lower rate of dividend tax from 7.5% to 20%, plus the abolition of the £2,000 tax-free dividend allowance.

Incredibly, even in the face of these hard facts, several Shadow Ministers, including Andy McDonald, Barry Gardiner and Annaliese Dodds, as well as Jeremy Corbyn and John McDonnell, are still repeating the lie that no-one earning less than £80,000 would be worse off because of their plans.

What’s particularly unfair is that MPs on a salary of £79,468 would see their take-home pay unchanged, whilst someone taking a similar income from their own business would pay an extra £6,927.

Although it is not unusual in other countries for dividend income to be taxed at the shareholder’s marginal income tax rate, the problem here is that the change would clearly make many people earning under £80,000 significantly worse off, contrary to Labour’s repeated assertions.

And that’s before we come to the indirect costs of introducing what would be one of the world’s most punitive corporate tax regimes. Companies may be an easy target, but they are only legal entities and cannot bear the economic burden of tax increases themselves. The reality is that all taxes are ultimately paid by people, either in the form of higher prices for customers, lower wages for staff or reduced dividends for shareholders – including the pension funds who so many rely on. And don’t forget McDonnell’s hare-brained scheme for the state to expropriate 10% of the shares of any company with over 250 employees – a surefire way of destroying investor confidence in the British economy.

The party’s complete lack of credibility on economic policy is even more evident from a howler in its manifesto costings, which stated that the higher rate of corporation tax would apply to £300,000 turnover instead of profit. This would have meant an increase in tax to someone with a net income of £40,067 of around £6,172. This has since been quietly rectified and the word ‘turnover’ changed to ‘profit’ – thank goodness for small mercies.

This is of course not the first time the Labour Party has confused or confounded turnover with profit. Shadow Business Secretary Rebecca Long-Bailey, often touted as a possible successor to Jeremy Corbyn, recently tweeted:

‘In 2017 Amazon subsidiaries in the U.K. paid £5 million in tax while making £8.6 billion in sales. That’s like someone on £30k paying just £17 in tax.

She was rightly ridiculed for such a basic misunderstanding of the difference between profit and turnover. There’s a serious point here though – If senior Labour politicians can get something this basic so wrong, why should they be trusted on anything else?

In the final days of this campaign, the Tories need to drive home just how damaging Labour’s economic agenda would be, including its underhand attempt to hike the taxes of hardworking small business owners.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.