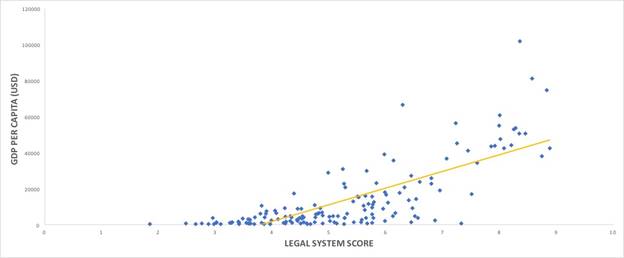

Cheating is bad. Not only do cheaters wrongfully take away from other people, but by flouting the rules of the game they undermine trust in the game, making other participants worse off in the process. Countries where cheating is more widespread and socially accepted, such as Greece, tend to be poorer than their more compliant neighbours. Countries where the people running the institutions cheat, such as many Latin American and African ones, tend to have not just lower but more volatile incomes. Consider the relationship between the quality of a country’s legal system – a good proxy for institutional probity and incidence of cheating – and GDP per capita. The correlation is unambiguous.

Figure one: The relationship between a country’s legal system and its GDP per capita

Cheating thus has not just distributional – who gets what? – but policy consequences. It is an issue with which policymakers must concern themselves, and, to their credit, in the UK they largely have. The last few years have seen the spotlight shone on benefits fraud. The Competition and Markets Authority polices abuse of market power by firms across a range of industries, whilst the Financial Conduct Authority monitors behaviour on financial markets specifically.

There is evidence that regulatory proliferation in financial services since 1979 has piled costs on suppliers and consumers – whilst doing nothing to prevent the 2008 crash – but, equally, there is little question that, by comparison, the UK regulatory environment over centuries helped the growth and continued success of its financial sector and wider economy.

Issues remain, and to some people one of the more salient ones is insider trading. The Times newspaper reported this morning that little manpower is devoted by the FCA to the prosecution of such conduct, which takes place when non-public information about a firm is traded on by people privy to that information, often because they are connected to management or other firm insiders. The Times says that, in advance of a profit warning, share prices for the relevant firm fell 67 per cent of the time, and the day before a takeover was announced, share prices rose 70 per cent of the time.

These look like big numbers, but are they? Imagine that, in the first case (a profit warning), share prices would fall 50 per cent of the time on the eve of the information being revealed. This would suggest that share prices rose with the same frequency as they fell in advance of the profit warning! Not much insider trading going on there. 67 per cent of the time may sound like a lot, but remember that stock prices either rise or fall, so this means that prices fall with double the frequency that they rise before a profit warning.

Is this evidence of insider trading? Not necessarily. There are lots of clever people poring over public company accounts at investment banks, trading houses, hedge funds and fund managers. And profit warnings, some of the time, can be anticipated – if, for example, oil prices have dropped precipitously, or a ride-sharing app has been in the midst of a harassment scandal. So, one would expect there to be a bearish bias in advance of profit warnings. Remember that, even then, share prices rise before the bad news 33 per cent of the time!

The same applies to price increases in advance of takeover announcements. Mergers and acquisitions are a subject of much interest among market participants, because they involve high fees for bankers and arbitrage profits for traders. Thus, a great deal of attention is devoted to takeover prospects and speculating about likelihoods that an M&A deal will go through. Again, the tilt towards price increases before takeovers suggests as much informed trading on the basis of publicly available information as it does illegal insider trading. Even then, share prices fall before a takeover 30 per cent of the time.

This is not to minimise the problem. Insider trading is bad for business, because it undermines trust. And, as the Nobel Prize winner Kenneth Arrow wrote, “much of the economic backwardness of the world can be explained by the lack of mutual confidence.” We need trust to have a growing and stable economy. So, cheating should be stamped out.

But two things must be kept in mind as we pursue this aim. The first is that statutory regulation may not be best-placed to address the problem. Insider trading was legal in Britain until 1980, yet financial markets thrived for the two centuries prior to that. Public confidence in markets was strong, at any rate by comparison to other jurisdictions, some of which had statutory bans on insider trading. How could that be? The answer is that stock exchanges – the operators of trading venues, and other market participants – did the monitoring and the sanctioning, so that the incentive to cheat was much-reduced because the penalties – permanent exclusion from future trading, a bad reputation – were high. Edward Stringham documents the effective role of stock exchanges as regulators in his book Private governance.

The second caveat is that the optimal amount of insider trading is not zero, just as the optimal amount of burglaries is not zero. We could try and stamp out all crime in society, but this would come at prohibitive cost, not only because it would (for instance) require paying for CCTV in every public and private space, but also because it would extinguish any individual privacy and right to be left alone. It simply isn’t worth it to reduce crime all the way down to zero. Equally, we want cheating to be low, but not zero.

The implication is that we will have to come to terms with the notion that some insider trading will always be a feature of stock markets. As information transmission improves and monitoring technologies become cheaper, the optimal number will steadily decline. Again, the prosecution of cheaters might perhaps be best done by exchanges themselves rather than bureaucrats. But the point is that such practices will never entirely disappear, because in some cases the rewards are simply too high. The recent Carillion debacle and Provident Financial’s gyrations in 2017 are two examples where the payoff from cheating was so great that it would be very difficult to eliminate.

What we want is a market environment in which, by and large, trust is well-established so most people, most of the time, can transact with the confidence that they are following the same rulebook. This may not always (100 per cent of the time) be the case. But it will probably be the case for 98 per cent of trades, 98 per cent of the time. A small amount of cheating, like taxes, is the price we pay for living in a civilised society.