Since Covid struck, we’ve heard a great deal about “Build Back Better” and the need to “rethink the role of the state”.

What these calls tend to have in common is a heavy bias towards ever more public spending and a bigger state. It’s a curious response to a pandemic that has revealed massive state failure: first in China which censored whistleblowers and allowed the virus to spread, and then in the many Western countries whose response to it was so inadequate.

Rather than a bigger state, there is a powerful argument that we need a leaner, more focused, more effective one.

Let’s start with health. Leftwingers endlessly assert that ‘austerity’ is at fault for Britain’s high coronavirus death toll. To listen to them, the NHS has undergone years of savage cuts, when in fact spending on the health service has risen thanks to the budget being ring-fenced. As the NHS Confederation points out, between 2007 and 2017, NHS net expenditure rose from £79bn to over £120bn.

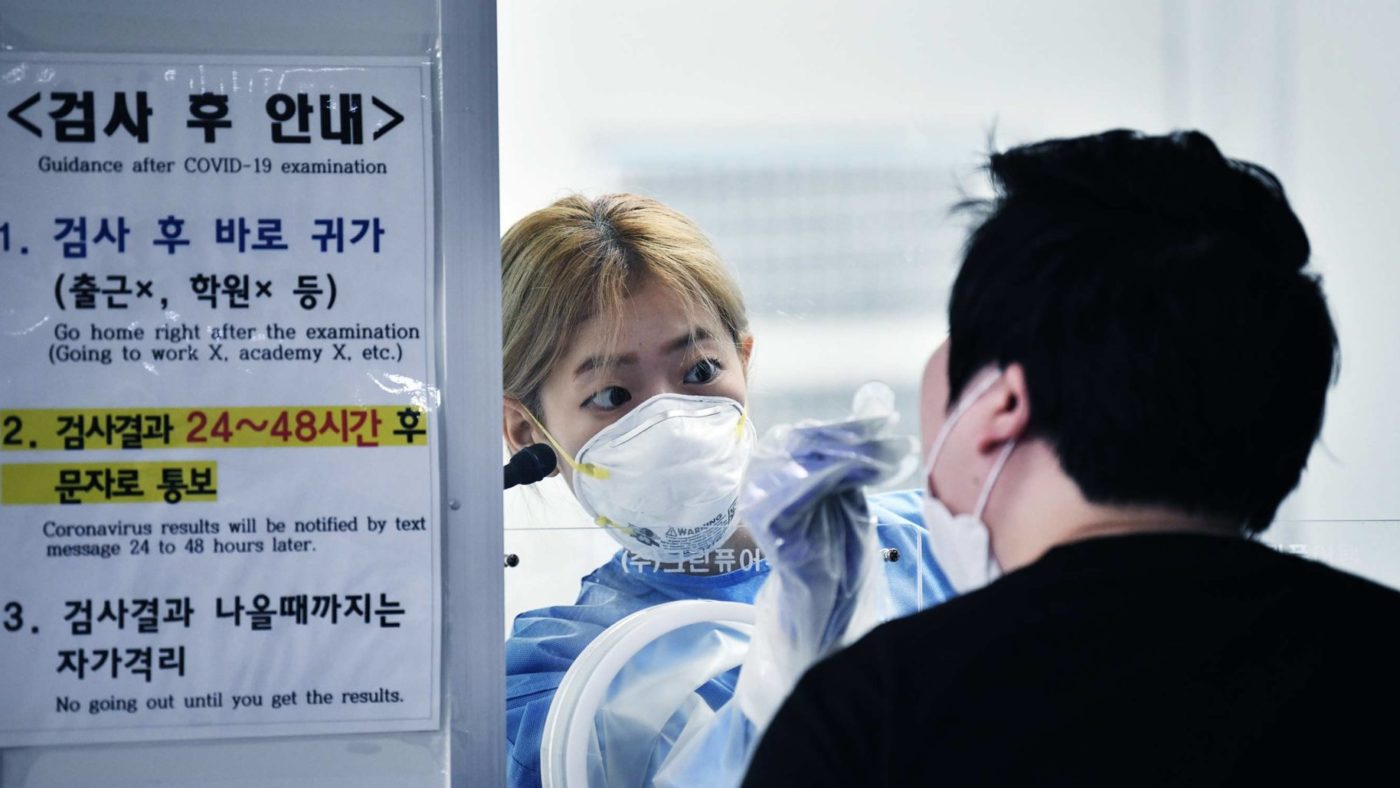

In any case, there is no evidence that more health spending produced better responses to Covid-19. The UK spends 9.8% of GDP on healthcare and has had 611 deaths per million people. Singapore spends 4.5% of GDP on healthcare, and has just under five deaths per million. Taiwan spends a bit more, at 6.1%, and has had 0.29 deaths per million. Hong Kong is at 6.2% and 12, and South Korea 7.3% of GDP, with just six deaths per million people.

What about the supposed “erosion of our public health system”? As it happens, Public Health England’s spending on infectious diseases grew over recent years – from £52 million in 2014/15 to £86.9 million in 2018/19. But, as Christopher Snowdon has pointed out, the real trouble was not resources, but priorities. Infectious disease took up just 2% of PHE’s budget, and they spent more than twice as much (£220m) on anti-obesity campaigning.

It was a fundamental failure of strategy that led to Britain’s high Covid death toll, not a lack of money. The Government planned for an influenza pandemic, not a coronavirus. Indeed, the National Risk Register concluded that “the likelihood of a new disease like SARS spreading to the UK is low” – and even if it did arrive here, the risk was only of an outbreak similar to that seen in 2003 in Toronto, where there were 251 cases over a period of several months.

Tellingly, the major concern during Exercise Cygnus, the simulated influenza pandemic in 2016, was whether there were enough bags for the hundreds of thousands of expected dead bodies. They did not envisage testing, tracing and isolating to prevent people from dying.

Even in the crucial months of January and February, knowing we could be dealing with a SARS-like virus, the experts on SAGE acted as if they were dealing with a version of influenza. PHE itself made no meaningful effort to scale up testing and tracing. And once the UK was fully in the midst of a pandemic, the NHS discharged thousands of untested patients into care homes, with dire consequences.

It’s hard to look at this litany of failures and avoid the conclusion that the British state performed pitifully. Does anybody seriously think that simply increasing the size of government will lead to better outcomes? If the state was twice the size, and tried to do twice as much, it would just make more mistakes.

On the other hand, a smaller state can be nimble and focused. Rather than try to direct the economy – as the Government is increasingly trying to do by intervening to prop up firms like bankrupt satellite manufacturer OneWeb – they should be focused on specific tasks. A key task, like protecting us from infectious diseases, can get more focus when the state is not trying to do everything. This is the key lesson from the Asian economies, which have smaller states than ours but were much more responsive to the pandemic.

Whether we like it or not, the British state has undoubtedly already become bigger during the crisis – something that even traditional opponents of ‘Big Government’ supported as a temporary measure. There’s a perfectly good case that this was the right thing to do to both fight a public health crisis and provide ‘insurance of last resort’ for businesses – but emergency measures tell us precisely nothing about the appropriate size of the state in the future.

Free markets, limited government, democracy and individual rights remain the magic formula for the most prosperous societies. The average income is eight times higher in the economically freest countries compared to the most repressed. If we are going to climb our way out of the current recession it will take entrepreneurship, dynamism, and innovation, all of which flourish with lower taxes and less red tape. On the other hand a bloated, interventionist state creates “Zombie companies” and “subsidy entrepreneurs” – unproductive firms that survive on cheap credit and grants rather than creating value for consumers.

Worryingly, the Treasury already appears to be developing plans to increase taxes and grow the state. In the first instance, raising taxes in the middle of a historically large recession – and while borrowing costs remain low – would be catastrophically stupid. Even the whiff of higher taxes will make businesses less likely to invest and hire, prolonging the downturn and resulting in lower tax revenue.

In the longer run, there needs to be a proper discussion about lowering spending, not just increasing taxes. Above all, we need to realise that ‘building back better’ is not the same thing as ‘building back bigger’. We should emulate the smaller, more focused states that have responded so well to this crisis. If we simply throw more money at the problem, we’ll have learnt entirely the wrong lessons.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.