1997 was, in lots of ways, a watershed year for Britain. I’m not just talking about Princess Diana and Tony Blair. One could also think of 1997 as the last year of the pre-internet and the pre-mobile-phone age. Both technologies already existed, but for most people, it was still possible to ignore them, or even be unaware of them: only about 15% of households had a mobile phone, and 7% had internet access. A year later, these proportions would jump to 26% and 14%, respectively.

It was also the year when Britain relinquished control over its last remaining major colony, Hong Kong, which makes it the symbolic final year of the British Empire. It was the year of the Devolution Referendum in Scotland, marking the end of Britain as a fully unitary state.

1997 was also the last year of pre-housing-crisis Britain.

Now, please don’t hit back, ‘Oh, so what you’re saying is, everything was fine on 31 December 1997, and then when people woke up on the morning of 1 January 1998, Britain all of a sudden had a housing crisis??’ Britain’s housing crisis had a very long lead time, building up slowly and gradually over many decades (see here for a chronology). Nonetheless: the way it manifested itself was a lot more sudden, and abrupt.

It was already true in the 1950s and the 1960s that Britain was falling behind the rest of Western Europe in terms of housebuilding rates. It was already true in the 1970s that housebuilding rates were dropping steeply even in absolute terms, never mind relative to anywhere else. There was already a period of accelerated house price inflation in the second half of the 1980s.

But with all that in mind – let’s have a look at the housing situation in 1997.

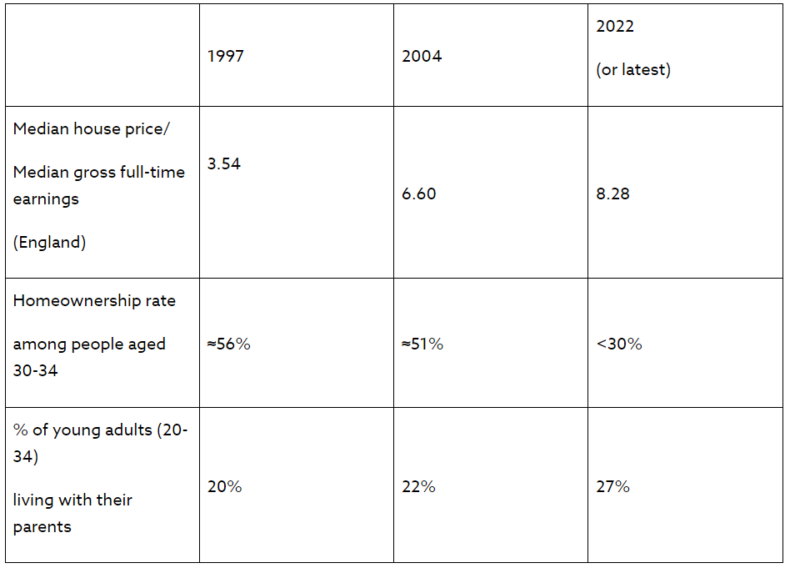

In 1997, the median house price in England was a little over 3.5 times the median annual full-time gross salary. Even in most of London and the South East, the ratio of local house prices to local earnings was less than 6. You could, for example, buy a typical house in Islington for 5.2 times the median local salary. If you were prepared to settle for one of the less fashionable parts of London, you could push that ratio to below 4.

You could buy a house in Oxford, Cambridge, Brighton, Bath or Bristol for less than 5 times the respective annual local gross salary.

Among young adults (aged 20–34), only about one in five still lived with their parents. The homeownership rate among people aged 30 to 34 was a little below 56%, which was already a drop compared to the beginning of the decade, but it still meant that most young adults became homeowners by the time they reached their early-to-mid 30s.

Thus, in the 1997 General Election, neither Labour nor the Conservatives had much to say about housing in their manifestoes, and what little they said was so generic, you could, in a blind test, not easily guess which statement was from which party.

Look, I’m not one to romanticise the 1990s (or at least not in that way). It was already true in 1997 that Britons had to squeeze into smaller properties than their Western European counterparts, with the exception of the East Germans (who had two things that Britain lacked: a good excuse, and catch-up growth). It was already true in 1997 that more than one million households were stuck on a social housing waiting list. It was already true in 1997 that Britain had steep private sector rents – it just mattered less, because far fewer people were private tenants. But all of that describes a housing situation which is merely bad, as opposed to catastrophic.

After 1997, the situation went from bad to worse, and then from worse to much, much worse. By 2004, the ratio of house prices to gross annual salaries had jumped to 6.6. Today, it stands at 8.3 for England as a whole, 10.1 in the East of England, 10.8 in the South East, and at 12.5 in London. The homeownership rate among people in their early-to-mid 30s has dropped to below 30%, and the proportion of young adults still living with their parents has jumped to 27%.

.

Now, if you plan on becoming the Yimbynator, who travels back in time to make sure that Britain’s housing crisis never happens, you would, ideally, go back quite a bit further than 1997. By then, the British housing market was already a tinderbox, and the fuse was already lit. But if you do end up in 1997, and your Yimby salvation plan does not work out – at least you know what to do: buy some shares in Apple and in that new online bookstore called ‘Amazon’, and, of course, a house in Britain.

This article was originally published on the IEA Blog.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.