It’s easy to take markets for granted. We have become so dependent on them that if we woke up tomorrow morning and found that they had completely disappeared, we would be in complete disarray.

I certainly would not know how to go about growing my own food, making my own suits or fixing the roof. We’d soon find that the “good life” would not be so good after all.

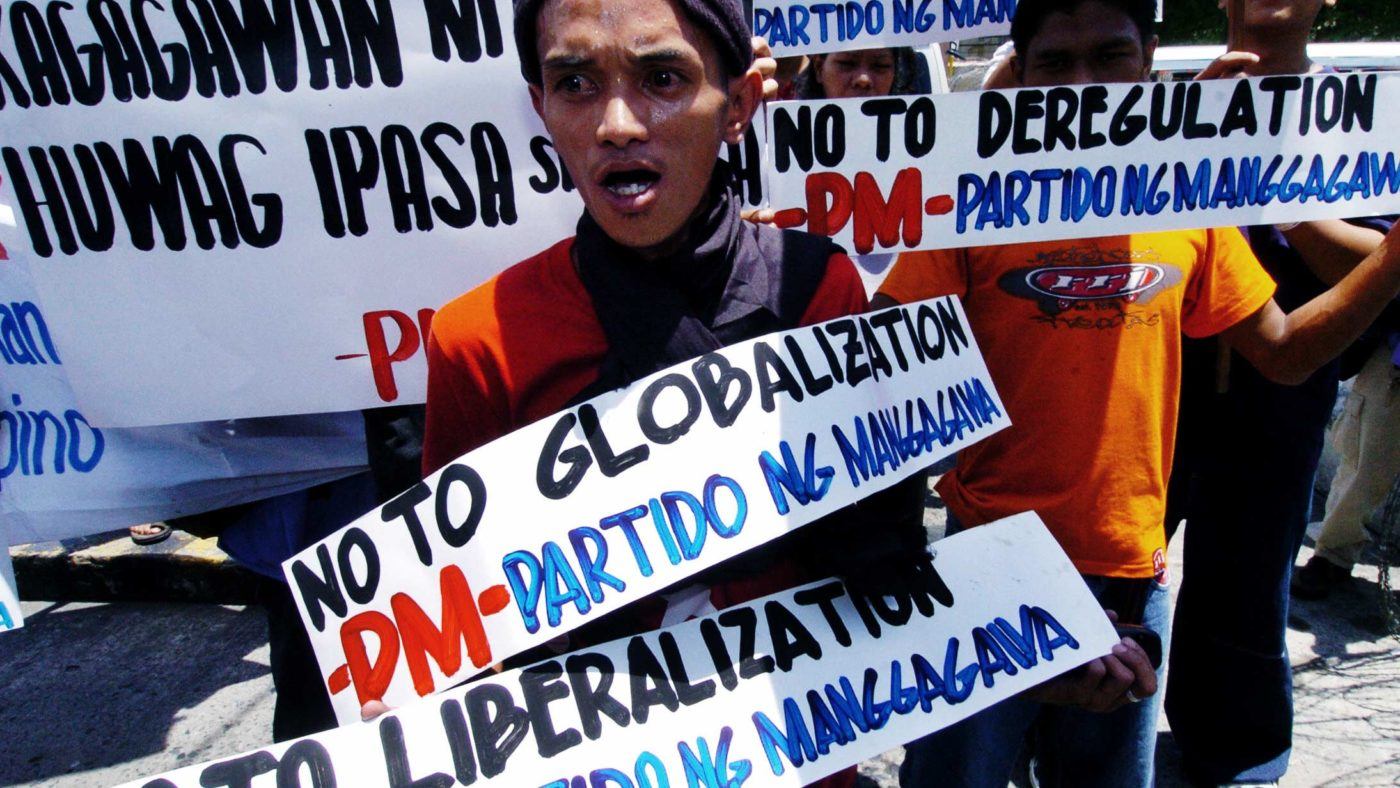

So how worried should we be? The protectionist and anti-immigration sentiment currently taking holding in the West has disturbing echoes of the deglobalisation experienced between the two World Wars, but that episode is commonly dismissed as an exception rather than the rule.

Is a retreat from markets really as rare as we like to think it is? History can provide an answer.

Economic historians once attested that ever expanding markets were a relatively “modern” invention; the “great transformation” had supposedly taken place in the 19th century, on the eve of the Industrial Revolution.

However, recent empirical research measuring markets over long spans of time and across multiple countries has shown that they are, in fact, nothing new: they have existed for millennia. Nor are they a purely Western phenomenon. On the eve of the Industrial Revolution, markets were just as developed in China as they were in Europe.

However, while markets have been identified in numerous periods of history, from ancient Babylonia to the modern day, and well beyond the West, the evidence suggests that they can disintegrate just as much as they can integrate. Markets might have a very long history – they have been around for as long as we humans have – but it has been a tumultuous one.

Take Europe as an example. Markets functioned reasonably well in Roman Europe, something which would hardly surprise any regular visitor of museums, many of which have on display an abundance of coins indicative of market-exchange, together with artifacts traded across hundreds of miles.

These markets were supported by the vast state infrastructure for which the Romans are famous – a stable coinage system, a taxation system that funded transport and utilities, and a common legal system to uphold contracts. However, once the Romans moved eastwards, perhaps in response to “barbarian” threats, markets soon began to crumble.

The lack of security and deterioration in infrastructure that followed the collapse of Roman rule led people to turn away from the market – to “batten down the hatches”. As more people did so, the degree of variety and regularity of supply progressively reduced, making relying on markets ever more risky.

So they unravelled and Europe entered the Dark Ages. Urban settlements shrank, as did population, and people began to de-specialise, moving away from market exchange and towards self-sufficiency.

Over the course of several centuries, markets began to rebuild themselves again, helped by bottom-up institutions, such as guilds of merchants and private judges, as well as by top-down institutions, including the Church and the state.

The larger states became, the greater the potential for markets to develop, unencumbered by multiple tolls, multiple legal systems and multiple currencies. Before long, a medieval commercial boom was in full swing. By the end of the medieval period, markets were around two to three times as developed as they were in the early ancient period.

This level of sophistication was not much surpassed by the time of the Industrial Revolution three centuries later.

However, before long, and with the medieval boom behind them, markets again took a turn for the worse. By the 17th century, they were collapsing across Europe as monarchs rampaged across individual property rights, stamped on parliaments and waged war with one another – including in the form of the immensely destructive Thirty Years War of 1618-48.

This was also the time of mercantilism – the interventionist and protectionist policymaking of the kind that Adam Smith was later to rile against.

Come the 18th century, things were looking up again. The British Industrial Revolution was born, and by the mid to late 19th century, the size and scale of markets reached new heights. The first modern era of globalisation was taking place.

The birth of the steam engine, which led to steam shipping and the steam train, helped to make the world smaller and flatter. Transport costs fell – dramatically. The telegraph helped to spread information, allowing arbitrage and new types of connections, and the new industrial class (factory owners and the working classes alike) pushed for reductions in tariffs.

And, it wasn’t only markets for goods that were affected. Labour and capital also crossed borders at an increasing rate. Around 30 million people emigrated from Europe to the USA in the century after 1820, and British capital funded ports and railways across the world. Britain was like the modern day China, exporting capital to far flung places.

However, globalisation was soon followed by deglobalisation after World War One. Countries turned inwards, tariff (and people) barriers were erected and trade spectacularly collapsed. The share of exports relative to GDP in 1913 was not to be seen again until 1973.

After another World War, ending in 1945, countries began to work together to rebuild global interactions. John Maynard Keynes helped to lead the way. Against this backdrop, the West entered a Golden Age. While the initial emphasis was on trade in goods, by the 1970s and 1980s, capital flows were unleashed. Globalisation was in full swing, once again.

By 2008, however, the world once again came close to a full scale unravelling, albeit beginning in financial as opposed to goods markets. Central bank intervention helped avert a crisis that could have made the Great Depression look like a very small blip in history.

However, the consequences are still with us today, and globalisation now stands on another precipice.

While markets have in general been trending upwards over time, they have been subject to serious fluctuations along the way. The deglobalisation of the 1920s and 1930s shouldn’t, therefore, be dismissed as a historical anomaly. And those who are worried about a return to those bad old days have good reason to be concerned because markets can collapse just as often as they can “globalise”.

Summer can quickly turn to winter, and without much warning. Sometimes external circumstances conspire against us. But, more often than not, we are ourselves responsible for the cold turn. So while it’s become fashionable to criticise markets, we need to avoid taking for granted the advantages they bring and recognise their vulnerable nature. We need to stop looking the gift horse in the mouth.