Quantitative easing was a great idea and we’d be lost without it. But now QE has saved us, we’ll be lost if we don’t get rid of it. That may rather put the kibosh on the Corbynista fantasy of the magic money tree but economics is all about trade offs.

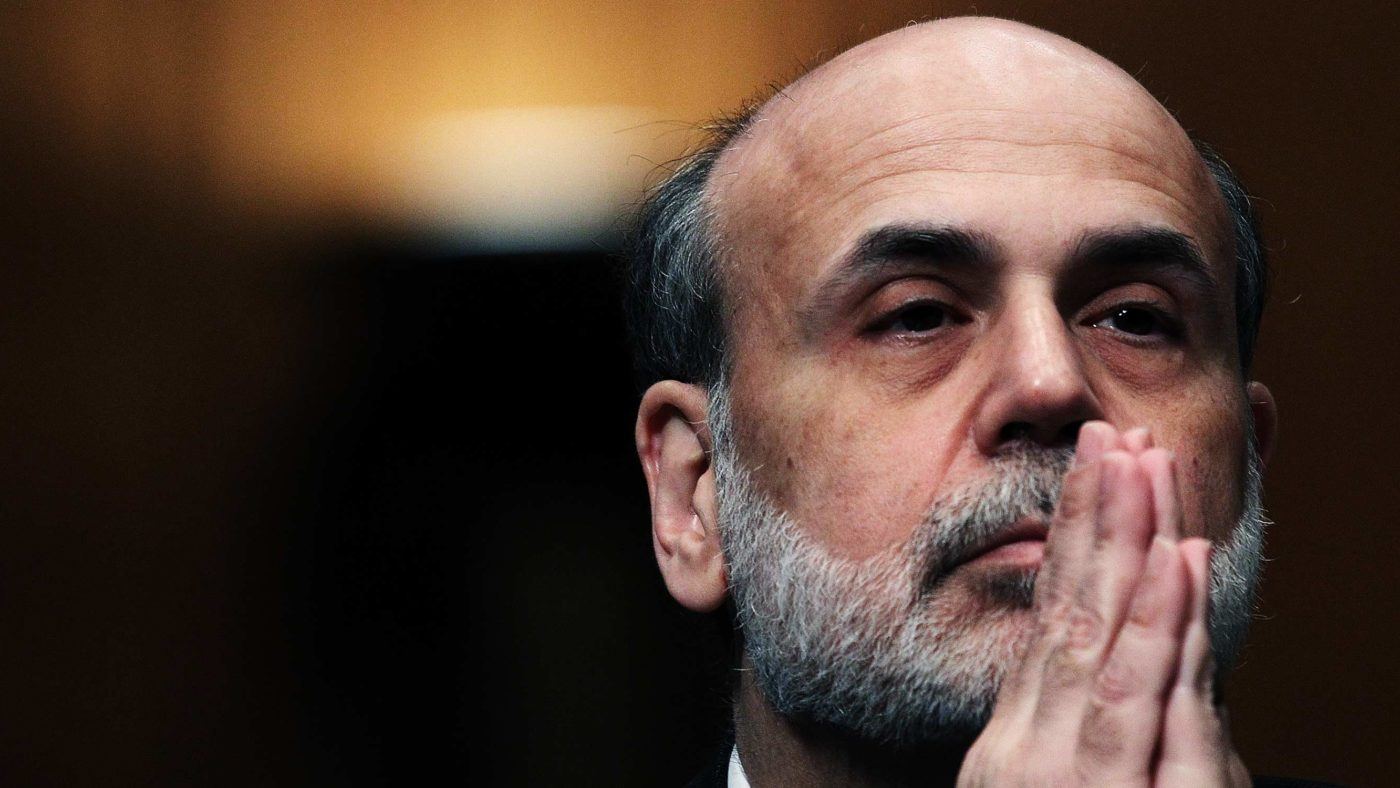

It was Milton Friedman, with Anna Schwartz, who pointed out what actually caused the Great Depression. What would have been a nasty recession went South as a result of the actions of the Federal Reserve. They allowed the money supply to contract, horribly and viciously. Ben Bernanke acknowledged this, declaring to the ghost of St Milton during the financial crisis that this time around they knew this and weren’t going to do it again.

The basic analysis comes from MV=PQ. Yes – sorry – an equation. Money times the velocity of its circulation equals prices times quantity demanded. Or another way to say the same thing, base money (ie, cash and equivalents) times the speed at which they change hands is the same as GDP, the prices and quantities of things in the economy. Of course, my description here will horrify those who really know this stuff but it is good enough for the rest of us.

What happened in the 1930s – and threatened to happen in 2008 – was that the MV part shrank. This would mean either P fell, that’s deflation – not a good thing to have in a debt-fired economy – or Q would, that’s the number of goods and services falling: a recession. However, in 2008 we weren’t sucking cash out of the economy at all; that supply of cash was just what it was the month or year before. But the speed of circulation fell sharply.

So we were facing either deflation or a fall in the size of the economy, or both. The way out of that tight spot was to increase the amount of money in the economy, which is exactly what QE did. We’ve now lots more cash around, as much as 10 times more, P and Q together wobbled but didn’t collapse.

Which is just great. Except, we now see car insurance rocketing up in price. We see most of the defined benefit pensions funds gasping at the amount of money that must be shovelled into them. This is the other side of QE.

There is a hint of this in The Guardian today. Motor insurance is up 11 per cent this year, only part of which is due to a tax rise. The other bit is a fall in the discount rate. That rate being something determined by QE. We’re all aware that a pound today is worth more than a pound in a year. The difference between those two values is the interest rate. QE has made a pound today worth more than a pound tomorrow. That’s what negative interest rates mean.

In insurance there is something called the Ogden Rate. Part of what insurance covers is the prospect of some horrible crash that means we need to be looked after for decades to come. Let’s assume that costs £100/year. In a positive-interest-rate world we need to put aside £100 for this year, £99 for next, £98 for the one after and so on. In a negative-interest-rate world we need to put £100, £101, £102 and so on. That Ogden Rate is now minus 0.75; that’s the interest rate that the insurance companies must use when calculating the present-day cost of long-term care.

Which is why, of course, car insurance is getting more expensive. No longer can earnings over the years top up the compensation amounts, instead we have to stump up more capital now than we will actually be paying for the care.

The same is happening to pensions. It used to be that to pay out £100 in a pension in a decade, say, we could put £90 into the pension fund today. With negative interest rates, brought about by QE, we now have to put £110 in today to pay out £100 then. Don’t take the actual numbers seriously, they’re just illustrative. This, to a large extent, explains the BHS saga. That pension fund was largely in balance in 2006, suffering in 2009 and a howling wasteland by 2016. No, not because no contributions were being made but because the capital sum required to pay those promised pensions kept rising as interest rates fell. Just about every other defined benefit pension plan in the country is facing exactly the same problem too.

Which is why we’ve got to reverse QE and do so quickly. The benefit of having avoided a depression was and is most assuredly worth a few years of higher car insurance payments. But, as we settle into approaching a decade of those induced low interest rates, the distortions in the economy are becoming greater and greater. It would only be slightly alarmist to start claiming that all companies with remaining defined benefit pensions funds are insolvent. Not being even a slight alarmist I won’t claim that – but it is getting close.

QE was the right tool for the times but it’s beginning to outstay its welcome. Time to get rid of it. We need positive interest rates. And we need them soon.