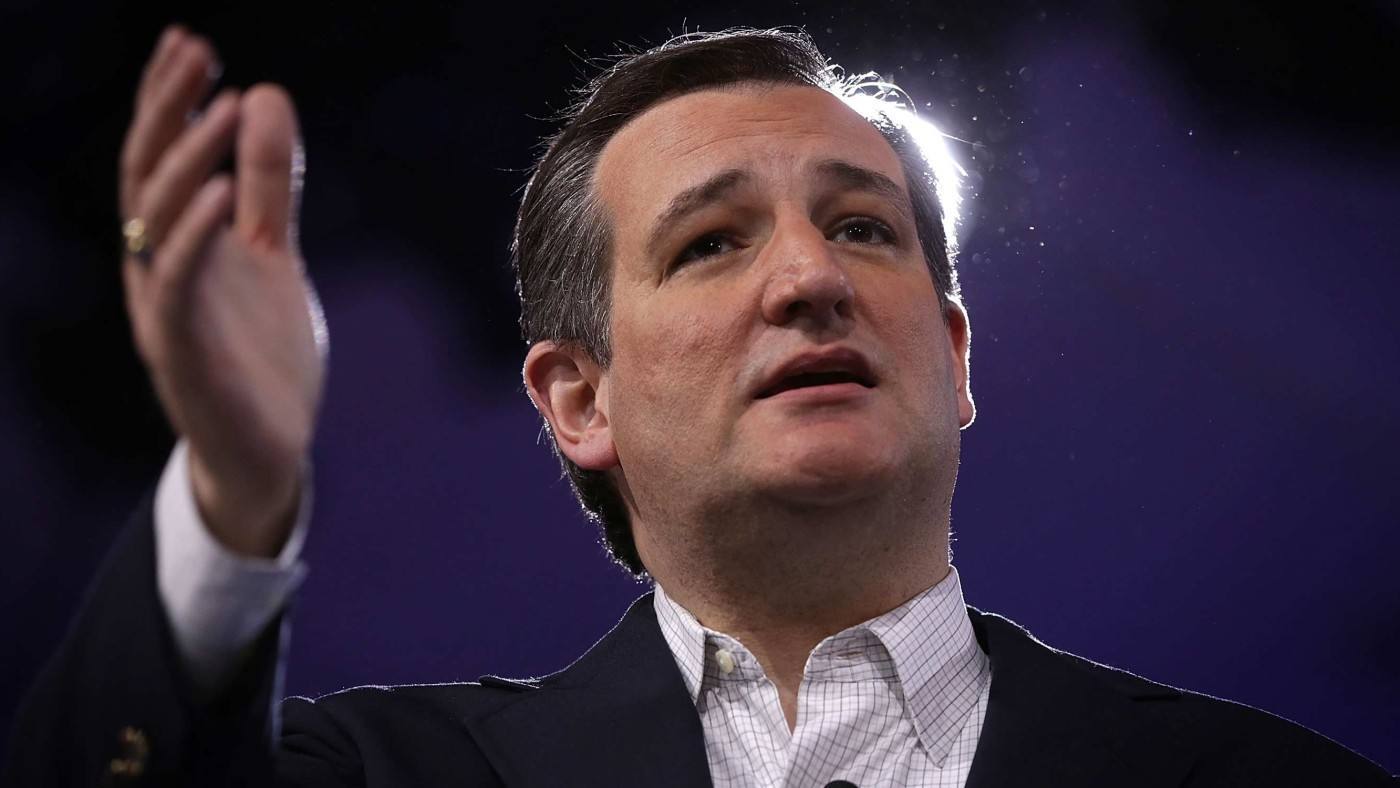

You probably know the bad things about Ted Cruz already. He’s an extreme Texan conservative who fries his bacon with the heat of his assault rifle. He spearheaded a pointless, wasteful government shutdown over Obamacare. He’s appeared at the same rally as a psychotically anti-gay preacher, being introduced by him the day after he said gays should be put to death. (Keeping the company of weird religious preachers is de rigeur for presidential hopefuls these days.)

All of this is reasonable grounds to dismiss him as a candidate, were he not the only person standing between Donald Trump and the Republican presidential nomination. But there’s quite a lot to like about Cruz too. Indeed, in some respects he is one of the most interesting presidential candidates in many years. In fact, he is probably not the swivel-eyed ideologue he likes to portray himself as, but an opportunistic, highly intelligent policy wonk.

Brains are not necessarily the best qualification for the presidency. The only career academic to have been elected president, Woodrow Wilson, was probably the worst since the Civil War. Still, Cruz is impressive on this front. Described as “off-the-charts brilliant” by Alan Dershowitz, one of his professors at Harvard Law School, he clerked for the Chief Justice of the Supreme Court and was named by American Lawyer magazine as one of the 50 Best Litigators under 45 in America.

His legal career included work on the Bush v. Gore case that decided the 2000 election; as Texas’s Solicitor General he won the Best Brief Award by the National Association of Attorneys General for five years running. Cruz may well be the smartest presidential candidate since Bill Clinton in 1996.

Cruz would like to come across as a chummy, George W. Bush-style guy, but as Ross Douthat has observed he is basically a nerd. It suits him to play the ideologue, for now at least, but his policy positions are remarkably wonkish.

Take his tax plan. It is totemic in the GOP that all tax cuts must be supported, and all tax hikes opposed. Cruz goes against this simplistic dogma, by proposing the right tax cuts – and the right tax hikes.

Economists generally agree that taxes on capital are extremely costly in economic terms, because they reduce investment and hence long-term growth. As with any compounding value, even a small dent to growth can have a huge cost in the long run. Conversely, taxing consumption is much less harmful in overall economic terms.

In this respect, Cruz’s tax plan is a (right-wing) tax wonk’s dream come true. It would merge taxes on wages, salaries, interest, capital gains, dividends, and business income into a single personal income tax of 10 percent, partially offset with a new 19 percent value-added tax.

Shifting the burden of taxation away from investment income should incentivize investment and, according to the Tax Foundation’s dynamic model, lead to a 13.9 percent higher GDP over the long term and 12.2 percent higher wages. Cutting out practically all deductions and exemptions from the system would remove harmful distortions, too.

Jonathan Chait has objected that this would be regressive, but I’m not so sure. In the UK, VAT is actually a mildly progressive tax, looking at total lifetime consumption. This is partially because of the many exemptions we have for things like food and clothes, but not entirely. All income is eventually spent on consumption, so even if we cut taxes on investment income now, once people consume that income they will be caught by the consumption tax.

But even if we look at a single year, the regressivity point can be addressed by lump-sum cash transfers to poorer people. And, sure enough, Cruz’s plan includes a massive expansion of the Earned Income Tax Credit, a simple wage subsidy to low earners.

Though tax credits like this are controversial among British free marketeers, they have bi-partisan support in the US, and wonks on both sides of the Atlantic have praised the EITC as an effective way of boosting employment and the wages of the low-paid. Indeed here in Britain both the Institute of Economic Affairs and my own think tank, the Adam Smith Institute, argued against cutting similar tax credits last year.

Until Cruz, even the most free market candidates kow-towed to the Iowan ethanol lobby. In bucking that trend and still winning Iowa, he’s blazed a trail for future candidates. He’s defended states that have legalized cannabis. His proposal to allow Americans to bypass the FDA drug approval process and use pharmaceuticals and medical devices approved in other developed countries is clever and could cut the cost of healthcare. It’s an idea that we in Britain should consider too.

Most intriguingly, Cruz has espoused a ‘market monetarist’ view of the Great Recession, which holds that the financial crisis and subsequent global economic meltdown that took place happened because the Federal Reserve kept money too tight – an idea that baffled Janet Yellen when he put it to her recently, who pointed out that the Fed cut rates repeatedly in the run-up to the crash.

Yet Cruz’s view is not as strange as it seems. Rates may not be the best way of measuring the stance of monetary policy – cutting them too slowly and allowing nominal spending to fall off trend, as happened in 2008, may lead to a ‘musical chairs’ situation where healthy businesses nevertheless fail because spending has declined across the board. This view, popularized by the Mercatus Centre’s Prof Scott Sumner, is gaining in popularity among elite economists. It is quite surprising to hear Cruz advocate it, but still welcome.

On the other hand, he has also flirted with the idea of a gold standard – which would be a very bad idea, to put it mildly. His immigration policies, which include a 180-day freeze on skilled H1-B visa issuance and the abolition of the Diversity Immigrant Visa programme, would hurt Americans and would-be migrants alike. He says he supports free trade, but has advocated for protectionist tariffs on imports. All these things are bad policies, though perhaps necessary to defeat Donald Trump

The best reading of Cruz is probably not as a Reaganesque ideologue but as a political opportunist in the Nixon mold, who has used the Tea Party as a vehicle for his own ambition. And a tack to the centre seems likely should Cruz win the nomination. He has talked of a pragmatic ‘opportunity conservatism’, even arguing that conservatives should embrace the political philosopher John Rawls, whose argument that society should be designed so that the interests of the worst-off are prioritized have heretofore been the preserve of the left: “The reason I’m a conservative is very simple … Conservative policies work.”

This is exactly right line for free marketeers. Free markets are not good because of some rigid moral principle. They are good because they work, especially for the poorest people. In Ted Cruz, so-called bleeding heart libertarians who believe this may have a surprising ally.

It may be slightly optimistic to hope that this means that, in office, he drops the bad ideas and keeps the good ideas. But Cruz’s policy wonkery is rare among top-tier presidential candidates. In a normal year, there may be better alternatives. This year, for all his faults, Ted Cruz may be the best shot the US has.