Amid all the opprobrium aimed at the Government this week, we should not forget that Liz Truss’ core economic arguments are right – we really do need both higher interest rates and supply-side reforms. The irony is that she has the makings of a popular agenda that she has made hugely unpopular.

To put that right, three key elements of her approach need to change – and quickly. She needs to be realistic about both her reforms and the implications of higher interest rates; she may have to remove Andrew Bailey; and she needs to end irrelevant and impossible policies and tone down her rhetoric in key areas.

The right macroeconomic approach to inflation: Higher interest rates not higher taxes

The big question between now and the next election is how to beat inflation and help with the cost of living. Truss stood on a platform of supply-side growth, no tax rises and higher interest rates. Rishi Sunak stood on a platform of no change, higher taxes and lower interest rates. Liz Truss won a comfortable victory and MPs should give her the chance to put her proposals into action.

But on supply-side growth, she needs to be honest with voters and recognise that most of her reforms are unlikely to deliver huge returns in 18 months. There are some areas (e.g. childcare) that might bear fruit more quickly, but most will not. (Investment zones, for instance, will take a long time to set up and get going).

The market is right to worry about a gap between rhetoric and reality if the Government thinks those reforms will do the bulk of driving down inflation. She must also recognise that politics will likely blunt some of those reforms. If she responds to setbacks by simply shouting at her opponents, her Government may well collapse. Supply-side reforms are necessary for long-term growth, but they take time and political care. She doesn’t have much of the former and she hasn’t yet shown much of the latter.

With this in mind, Truss must focus a lot more on how higher interest rates will drive down inflation. The Bank of England’s refusal to follow the Federal reserve with a 0.75 rise in rates, widening the gap between US and UK rates even as the Government accelerated fiscal loosening, was a disaster. At the moment, the markets worry that Truss and Kwarteng do not have a plan – because the flip side of higher borrowing is higher interest rates.

The biggest risk is that the Bank of England doesn’t follow the Government’s lead and push interest rates up fast enough, leading to more confusion and chaos, and undermining a vital plank of Truss’ economic strategy. She should therefore be preparing to remove Andrew Bailey unless interest rates rise rapidly in the next few weeks, if necessary through changing legislation to allow the PM to replace the Governor. This might sound like a drastic step, but if she fails her government risks falling apart, inflation may not come down, and her political capital will run out. Rather than picking pointless fights left, right and centre – with Treasury officials and the OBR, for example – she needs to focus on this one crucial battle, and win it.

The public vs inflation

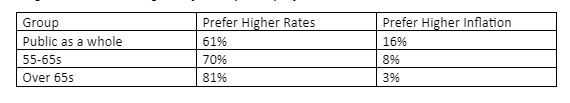

It’s worth noting here that there is huge public support for bringing down inflation via higher rates. The Bank of England asks people if they would prefer higher interest rates or higher inflation. People overwhelmingly want higher rates, as the table below shows (original data in detailed tables here). This is particularly true of older voters.

It is worth remembering that five million households have fixed income annuities. Millions more rely at least partly on cash savings, or other pensions not fully linked to inflation. Older people, the bedrock of the Tory vote, want higher interest rates because they are being hammered. And they aren’t alone; millions of younger renters also lose out from higher inflation rates which push up the cost of living and even student loan debt.

Of course, those with large mortgages will lose out. But only around 28% of households have any mortgage, (around 6.8 million out of 26 million), meaning that the group who lose out from higher rates is much smaller. Many borrowers will have paid down large elements of their mortgage (e.g. be on year 15 of a 25-year term) and have only £50,000-£100,000 left.

Those borrowers will also benefit from the energy and tax packages already announced. The National Insurance and Income Tax cuts that announced last week will mean a dual income household both on full time average UK wages of £31,876 will save, by next April, around £870 a year. On top of this, the energy price cap will likely have saved them an additional £75 a month, assuming £900 support to an average household.

Overall, that comes to a pretty considerable £150 a month – enough, for many households, to outweigh rising mortgage rates. Truss and her ministers need to do far more to make this point, and more generally to highlight the support the Government is already offering households. Polling shows by over 2:1 people supported the NI and income tax cuts and this support needs to be highlighted.

Of course, a small group of highly indebted households, especially in London, will lose out. Perhaps some of the commentariat hysteria is because they are kind of people who stand to lose out from higher mortgage rates. Highly-leveraged 40-something mortgage holders living in expensive London homes are among those shouting that rates must not be allowed to rise (not to mention the financial institutions that made bad bets on permanently low rates). The coverage has focused endlessly on the cost of high rates to mortgage holders, while saying next to nothing about the provincial savers crucified by lower rates – it is those people Truss must now champion.

In terms of communication, the PM needs to make crystal clear that she is choosing higher interest rates over higher taxation. That she understands most people’s hatred of inflation and has a plan to tackle it, and that low rates and high borrowing mean prices going up and up. But she needs to set out that plan honestly to the public. There Is No Alternative to higher interest rates – except higher taxes on already struggling households.

The hysteria about house price falls also needs perspective. If house prices fall by 20%, they would be back roughly where they were at the start of 2020. Polling from YouGov found that a clear majority think house prices falling would be good for the country – and just 4% of voters think house price rises are good for the country.

There’s historical precedent here too. In 1992 the Tories had presided over a house price collapse with prices falling by roughly 20% from their peak as rates rose to beat inflation – which had fallen from double digits to just 3.7% by the election of the same year. And this was a time when there were more mortgage holders and less older households. So, the electoral history backs up current polling – cutting inflation down has to be the priority, not propping up over indebted households and house prices.

Ditch irrelevant or unhelpful policies and tone down the rhetoric

While there was always going to be a degree of turmoil with a radically new economic approach, Truss and Kwarteng certainly made things worse with what looked like a cavalier approach to tax cuts. The 45p tax cut spooked markets, not because it meant £2bn in extra borrowing, but because it looked completely politically naive. So while she zeroes in on beating inflation, Truss also needs to ditch policies opposed by either her Cabinet or the parliamentary party and focus on the reforms she can actually get through.

For instance, the idea of liberalising immigration, or a trade deal with India (just 1.2% of our exports) that involves visa liberalisation is a non-starter. It is one thing to pursue an economic strategy supported by Tory members and which is in tune with the public. It is another to rip up key manifesto pledges for no real economic gain, alienating swaths of voters in the process. Put simply, if Truss wants Tory voters to support her in tough times, she needs to avoid policies they hate. Spending restraint also has to be politically acceptable, which means dispensing with madcap ideas such as decoupling benefits from inflation. Plough on with these kinds of policies and they risk destabilising things even further.

Communication is also key, both for the public and calming the markets. That means an end to rhetoric that implies we can simply borrow endlessly due to supply-side reforms coming down the track. Instead there needs to be a clear message that borrowing cannot and will not rise forever. As a first step, putting a cap on the amount of energy relief per person would help (e.g. twice the average UK person’s usage with a higher threshold for the over-70s and those with children). The scrapping of VAT relief for overseas shoppers should be ditched, and if not scrapping it outright, Truss should at least promise to review the 45p rate cut so that if it does not boost revenue it will be reversed.

But more widely, she needs to keep returning to her core argument – that if we want to get inflation down, the only alternative to higher interest rates is higher taxes – the very Sunak approach that left us with the highest rate of inflation in the G7 by summer 2022.

Talk of ditching Truss after a lengthy leadership contest is absurd, but she urgently needs to start talking clearly and persuasively about her core arguments and pick the right fights. That means leaving out irrelevant or impossible policies and careless rhetoric, and being more realistic about what supply side reform can achieve. She needs to refocus – and do so fast.

Click here to subscribe to our daily briefing – the best pieces from CapX and across the web.

CapX depends on the generosity of its readers. If you value what we do, please consider making a donation.