It is surprising how little comment has erupted over how close the Senate came in January to passing Audit the Fed. It certainly didn’t escape the notice of Ben Bernanke, former chairman of the Federal Reserve, who rushed out a blog post to warn of the danger that the Congress might enact a system of regular oversight in respect of monetary policy. And it certainly didn’t escape the notice of Senators Rand Paul and Ted Cruz, who, on the eve of the Iowa caucus, fell to feuding over this head.

Audit the Fed passed the House most recently in November. It was at least the third time the House has endorsed the measure, which is more formally known as the Federal Reserve Transparency Act. When the House passed it the second time, in September 2014, the vote was 333 to 92, with 106 Democrats joining the Republicans in voting for a bill that has been called the crown in the career of Congressman Ron Paul, in that it was passed shortly before his retirement.

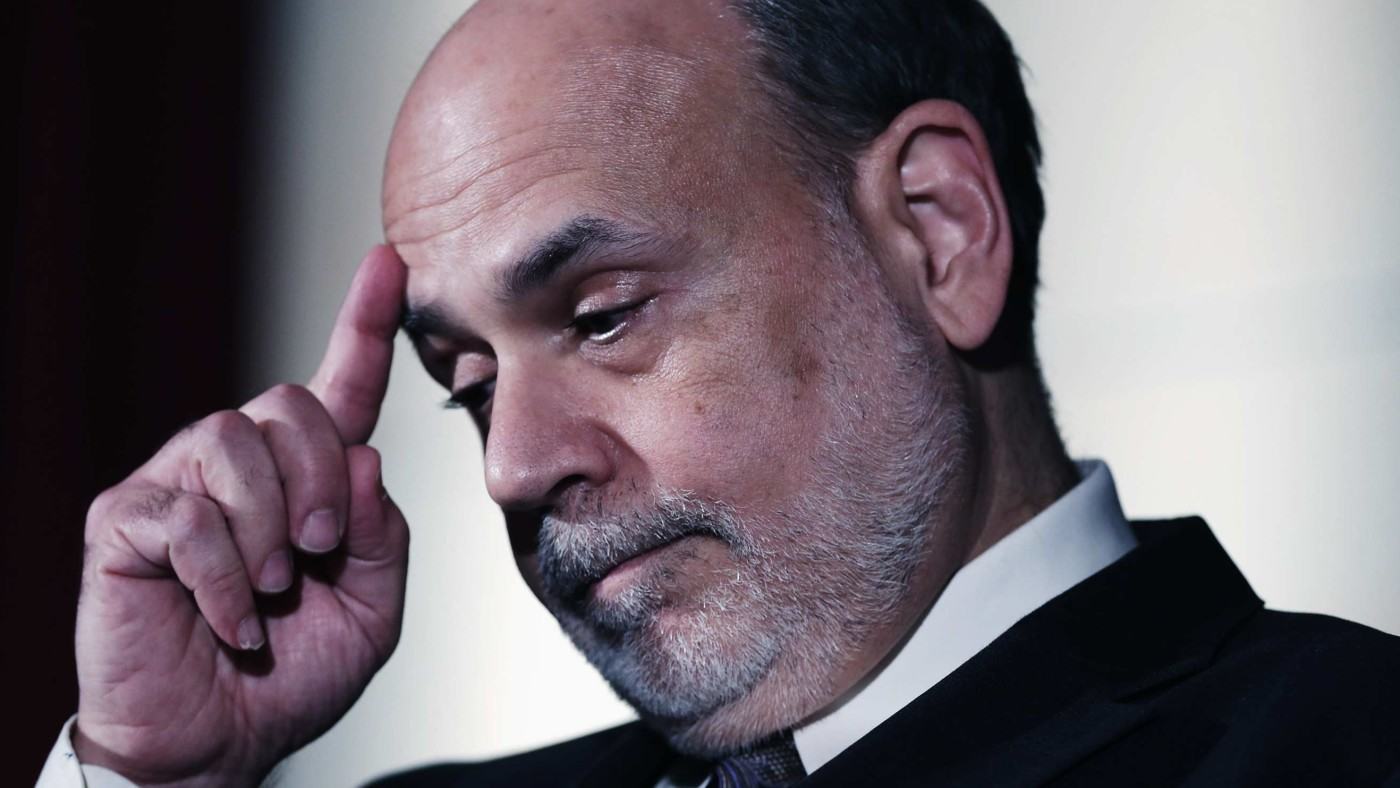

With Audit the Fed now before the Senate, Bernanke sprang into action in his blog at the Brookings Institution. He warned that Audit the Fed is not about auditing the Fed in the traditional sense. That has been done regularly for years by the Fed’s accountants, at the moment Deloitte & Touche. It notes that the results of the regular financial audit are online and all the securities owned by the Fed are listed, right down to their identifying numbers.

What worries Mr. Bernanke is that Audit the Fed would make “meeting-by-meeting monetary policy decisions subject to Congressional review and, potentially, Congressional pressure.” That’s because it would repeal restrictions on what the Government Accountability Office can examine. The “most important such restriction,” Mr. Bernanke reckons, blocks the GAO from reviewing “deliberations, decisions, or actions on monetary policy matters,” as well as related internal discussions.

Why, though, shouldn’t the Congress and its investigative arm exercise such power? It is the branch of the government to which the Constitution grants not just most but all of the monetary powers granted to the federal government. These are the power to tax, spend, borrow on the credit of the United States, regulate commerce, deal with counterfeiting, and — most importantly — coin money and regulate the value thereof, and of foreign coin, and fix the standard of weights and measures.

It’s not as if Congress is satisfied with the performance of the Federal Reserve this past decade or so. Mr. Bernanke himself— and his successor as chair, Janet Yellen — have confessed to their failure to foresee the crisis that came upon the economy in 2008. Congress itself has grown concerned that policy errors of the Fed have contributed to the downturn in 2008 becoming what is now known as the Great Recession.

Mr. Bernanke, moreover, once boasted, on a CBS broadcast, that the Fed could normalize its interest rate regime. “We could raise interest rates in 15 minutes if we have to,” he said in what could eventually become his professional epitaph. He introduced at the Fed the regime of forward guidance and regular press conferences — all part of what the New York Sun ridiculed as “The Verbal Dollar.” Yet with all that transparency, what has the Fed accomplished?

“Central banks struggle to make things clear,” is the way the London Financial Times put it in the headline over its weekend editorial. It reckons that the “image of central banks as omnipotent guardians of the global order” has “come in for a battering.” It faults the central banks of Japan, Red China, and, to a degree, Europe. “Even” the Federal Reserve has, it says, “some credibility problems.” It calls the revolution in central banking of the last two decades “incomplete.”

No wonder Sens. Cruz and Rand Paul fell to feuding over who was the true heir to the ideas of Rand Paul’s father, Ron Paul. It was Cruz who became last year the first Republican candidate to endorse, in a national debate, linking the dollar to the constitutionally sanctioned specie of gold. Then, at the last GOP debate, Rand Paul criticized Cruz for failing to show up for the cloture vote this month on Audit the Fed. When it comes up for a cloture vote again, it’ll be something to watch.