Making something from nothing is a plan that never works. Except when it does: today the owners of cryptocurrencies must feel like they have stumbled on the alchemist’s secret.

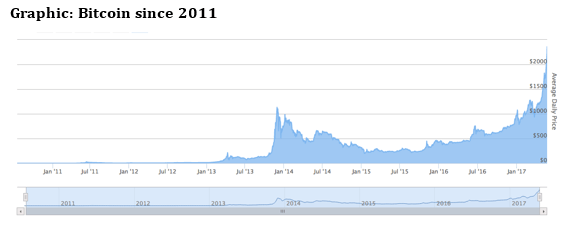

Cryptocurrencies are the private, digital units of value that scoot invisibly around the internet and that some claim will eventually supplant the dollars and pounds that we count as money today. Only seven years ago a single Bitcoin – the first, the best known and the most accepted cryptocurrency – was worth roughly $0.0025. Today it is worth well over $2,000.

From: https://99bitcoins.com/price-chart-history/

Until last weekend, when the value of Bitcoin and other cryptocurrencies fell by 30 per cent or more in the space of a couple of hours. So is the bubble about to burst?

Cryptocurrencies – an unhackable electronic medium of exchange based on blockchain or similar “distributed ledger” technologies – are volatile. They can lurch from boom to bust (and back again). But over the past few months, that tendency has been in one direction. Currencies have been doubling, quadrupling, or more. Some have increased over 1,000 per cent. Digital fortunes have been minted overnight.

Bitcoin is the biggest in terms of market capitalisation, but there are hundreds of others. Ethereum, Litecoin and Ripple have also been rising in value since the beginning of the year. It is difficult to say for sure why this is happening now, but here are some pointers.

The most obvious reason is that conventional investments are unattractive. Cryptocurrencies are “alternative assets”, and today there is demand as never before for investment vehicles that are not conventional companies or government debt (the bedrock of investment portfolios in an earlier era). Most traditional financial instruments, such as government securities and cash, now produce nothing or less than nothing in the way of real return. Investing in even the bluest of blue chip government debt is a one way ticket to bankruptcy.

Company shares have also produced very little in face-value terms since the stock-market high of almost two decades ago. Cryptocurrencies, despite their massive volatility, have surprisingly proved one of the best places to park your money over the last few years. In 2010, a Bitcoin pioneer bought two pizzas in a Florida take-away for 10,000 Bitcoins – the first ever real world cryptocurrency transaction. Today 10,000 Bitcoins are worth $23 million.

That may sound like big money, but it is not in terms of global capital flows. The relative smallness of the cryptocurrency world is another reason why currency values have risen so dizzyingly in recent months. The momentum effect that marks all investment is multiplied in cryptocurrencies: once the cryptos start to rise, the hot money pours in and because this is still a very limited market there is a disproportionate price effect.

But even the largest are rather small. At around $36 billion the total market cap of Bitcoin is still only about one sixth of the value of the Coca Cola company. Some of the newer, smaller currencies have seen massive price increases in percentage terms, but their market cap is usually miniscule (PizzaCoin may seem like a literally hot investment, up several thousand per cent over the last few weeks, but bearing in mind its total market capitalisation is slightly less than $14 I would counsel caution for now).

But never mind the numbers. There are other forces pushing cryptocurrencies into the global consciousness.

One is the anti-establishment effect. Suspicion of governments, currency manipulation and surveillance always play well in the online world where cryptocurrencies live.

When the idea of a decentralised blockchain of transaction records linked by encrypted digital signatures or “hashes” was first proposed in 2008, the paper was signed by someone with the made-up sounding name of Satoshi Nakamoto. This person has never been identified, and may not even exist. Such a layer of mystery is exactly what the internet mind loves, and the digital society theorists and anarcho-hacker warriors fell upon blockchain as if it were scripture.

Since that moment, the cryptocurrency bubble has tracked another inflationary phenomenon: the malignant rise of grievance-based populist politics. In the crypto world, dollars and pounds are fake currency, and now is take-down time for those elitist central bankers.

But there is also a network effect, which, by contrast, is real. A Bitcoin is of little use if no one will accept it. Today there are at least 16 Bitcoin ATMs in London, and more in other cities, and some large companies accept Bitcoin – Dell, Expedia and Microsoft are examples. In Prague there is a cafe that only accepts Bitcoin.

There are other real-world dimensions to cryptocurrencies. It is, for example, becoming apparent that distributed ledger technology has a lot of applications beyond currency. Ethereum and Litecoin are really “smart contract” technologies applicable in law and supply chain management; the “tokens” or coins are just ways of paying for the contracts to function.

Ripple is an asset transfer protocol that has already been adopted by big banks with the Ripple coin as the functional medium of exchange, something that has the potential to take the place of slow and costly banking technologies such as the international wire transfer system.

The currencies are rising on the back of this real world interest. But today’s soaring currency values are a bubble ripe for bursting. People are buying cryptos without any clear idea of what they are and what they are for. They are not backed by assets or revenue streams: investors are buying little more than hope, and hope is usually over-priced. Cryptocurrency values crashed in 2011, 2013 and 2015, and they will do so again.

And some of the promises of cryptocurrencies are not sustainable. For one thing, they are not really private. Although the underlying blockchain is anonymous, the points at which value is transferred from conventional “fiat” currencies to cryptocurrencies and back are not. It is impossible to trade on any reliable exchange without revealing several levels of personal information. Even supposedly anonymous peer-to-peer exchanges usually require some level of personal authentication.

For another thing, the cryptos are not fully secure. Although the blockchain is in practice unhackable – hacking the chain is like trying to dig a hole in the ocean – the exchanges where currencies are traded and held are very hackable, and so are online “wallets”.

Also, the currencies are supposed to be “frictionless” – that is, transactions that are instant and cost free. In practice, they are far from that: the blockchain technology requires a confirmation process that is getting more time consuming as the currency grows, and fees are extortionate, with wide bid-ask spreads, exchange fees, and transfer costs. Buy a Bitcoin today and you will lose 4 per cent or more just from the trade.

Long-term, though, I wouldn’t bet against the cryptos, especially the five or six that have $1 billion plus in market capitalisation. They have had an awful lot of bad news thrown at them over the last few years, with hacked exchanges, stolen coins, regulatory roadblocks, and challenges to the technology. Every time, though, they have bounced back, simply because there is a growing market for what they can do.

There are only two ways to make money in finance. One is to be a salesman. The other is to buy something cheap that will be wanted in the future. Are cryptocurrencies cheap? That is an open question. But they certainly seem to be wanted.