This is a vitally important year for the UK’s mobile phone industry. Ofcom will be auctioning off a new allocation of spectrum that will be used by mobile phone companies to offer additional internet services to customers. The first auction will supplement the current ability of mobile providers to offer 4G internet services, while another auction will free up spectrum that will likely support the deployment of 5G services in the future.

This auction comes at a time when there are growing concerns over competition in the industry. The UK’s mobile phone market is effectively a natural oligopoly with four key players: BT/EE, Vodafone, O2 and Three.

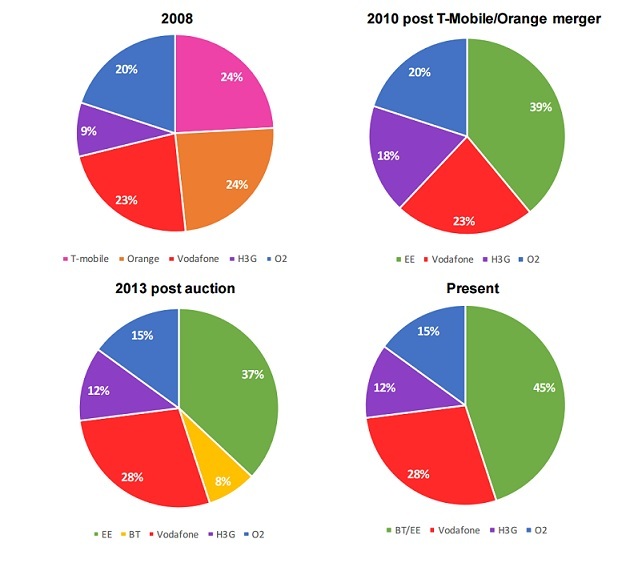

In 2008, the mobile spectrum allocation was roughly in balance, meaning that mobile phone operators had similar capabilities to provide services to customers. However, in recent years this has changed – potentially to the detriment of customers.

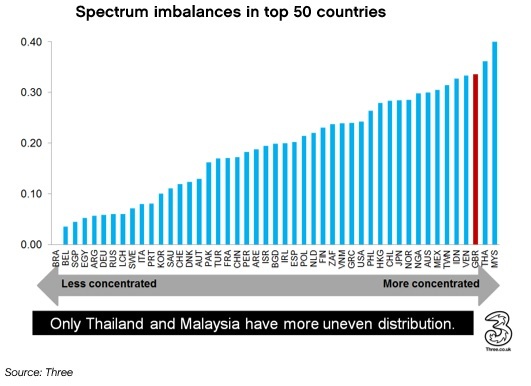

Following the 4G auction in 2013 and the merger of BT and EE, the market concentration has grown dramatically. BT/EE now dominates the market, controlling 45 per cent of the UK’s mobile spectrum. That currently leaves the UK with the third biggest spectrum imbalance among the world’s 50 largest economies.

Any further disparity in spectrum allocations could have implications for competition. There are already huge differentials in mobile phone providers’ share of data traffic, compared to their share of the mobile ratios. For example, data from Ofcom shows that despite Three receiving more data traffic than BT/EE, BT/EE has nearly four times the capacity.

There is also evidence that BT is hoarding much of its allocation by not using it, which might be a way of erecting barriers to entry for its competitors – although, of course, BT would argue that this is for the purposes of expanding services for its customers.

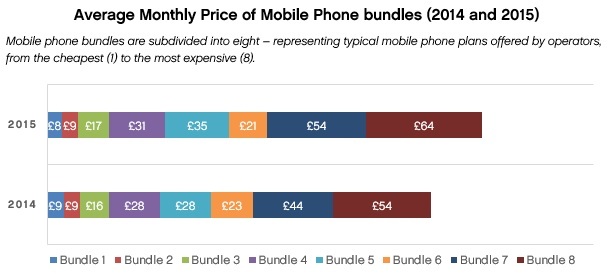

The UK’s mobile phone market has been a success story. It is cost-competitive compared to its EU counterparts, and prices have historically fallen. Yet recent trends in the costs of mobile phone plans will be of concern to customers. Between 2014 and 2015, the relative cost of the typical mobile phone bundle increased by over 13 per cent on average, according to Ofcom’s latest data.

Part of this increase could, of course, be due to costs that are unrelated to spectrum allocations. But the very fact that this large increase in costs has come while the proportion of spectrum has become increasingly imbalanced towards BT is a concern.

Of course, the domination of BT is not only a worry in the mobile industry. It is notable that – along with the mobile market – BT already has a disproportionate influence in the broadband industry. BT’s competitors are often required to use its BT Openreach infrastructure to provide broadband to customers, which opens up a major conflict of interest issue.

The Centre for Policy Studies – among others – last year called for BT Openreach to be “structurally separated” from BT to avoid such a conflict of interest, but Ofcom decided against referring this issue to the Competition and Markets Authority. BT’s disproportionate influence in the broadband industry will therefore continue into the foreseeable future.

In a market that is a natural oligopoly, intervention can – on occasions – ensure that competition is sustained and that no one company becomes overly dominant.

To give Ofcom credit, they accept that there is a risk of BT becoming too dominant in the mobile phone market. They are proposing a cap on immediately deployable spectrum, which effectively rules out BT obtaining a greater share of spectrum that can be used for 4G services.

Yet it is open to question whether the cap is at the appropriate level. The proposed cap is so high that it will not tackle the problem of BT owning exclusive rights to spectrum and not using it (the problem of hoarding). But Ofcom will also have to take into consideration that asymmetry in the spectrum market has partially arisen from business investment decisions, which would – quite understandably – discourage further intervention in the 4G auction.

However, it is the lack of any constraints on the 5G auction that is potentially the most serious issue from a competition perspective. It leaves open the possibility of BT gaining an even more dominant position in the mobile phone market, which – when accompanied with its disproportionate influence in broadband – would open up the potential for it to dominate the telecoms industry more broadly.

In a rapidly changing mobile industry, there is a danger that already dominant players will be able to further entrench their position, to the detriment of competition in the industry. It is crucial that in the upcoming spectrum auction, Ofcom ensures that this does not occur.