China has been a big issue for Presidential hopeful Donald Trump. It was in a 2011 interview with the Wall Street Journal that the real estate magnate first called for a tax to be placed on all Chinese imports. In that interview, he claimed that in 2012, the US would lose $300bn because of trade with China. “China has been taking advantage of our leaders for a long time. It’s either going to equalise, or guess what, we don’t need China. We need oil; we don’t need China.” Trump did not see the poetic irony when the interviewer questioned Chinese investments in US industry, and – indeed – within his own company. “I have great companies – I have the biggest bank in the world, the Chinese bank, right in Trump Tower. I’m very happy about it”.

It was poetic because Trump unintentionally demonstrated how free trade works and that he was both happy and angry about it. In 2012, the US did not lose $300bn with China because of free trade. That figure reflected the estimate for the current account deficit – the difference between exports and imports and flows of salaries, profits, rents and other financial transfers across borders. In an international system the balance is corrected by a corresponding inflow of long-term capital and loans, parcelled out to American consumers and producers. China sells concrete, glass and cheap toys and lends Americans the money to buy them. Trade deficits boost the living standards of consumers, at least in the short term.

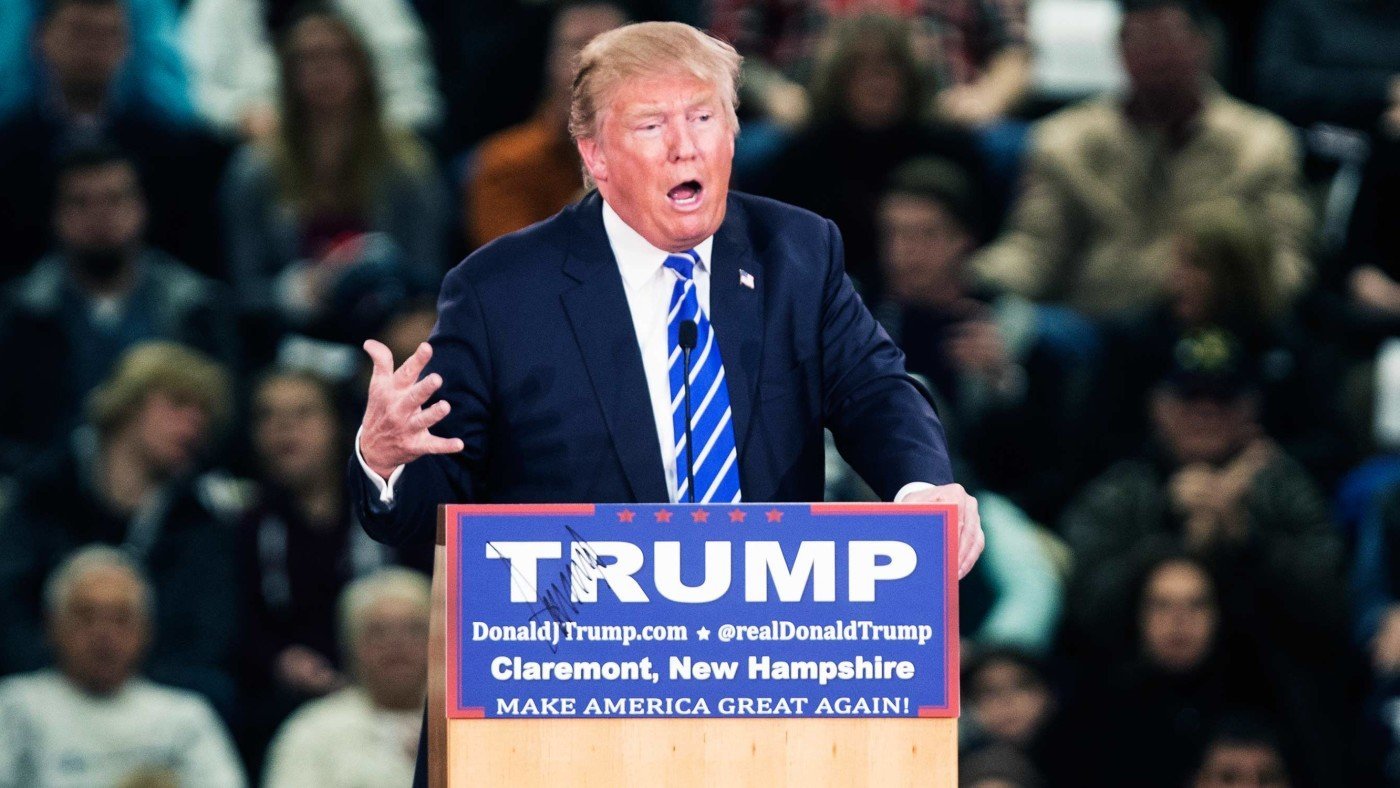

Yesterday, in an interview with the editorial board of the New York Times, Trump intensified his antipathy. “I would do a tax. And the tax, let me tell you what the tax should be … the tax should be 45 percent,” Mr. Trump said. He added that he was “a free trader but that it’s got to be reasonably fair,” and justified the policy by suggesting that China distorts the market by intervening to keep its currency — the renminbi — cheap.

While the US-China trade deficit has grown, standing at $343bn (£234bn; €315bn) in 2014 — compared to around $84bn in 2000, there is little economic justification for a leading industrial country to impose high trade tariffs. The dollar has bought between ¥6-¥6.5 for the last five years, compared to over ¥8 a decade ago, when China’s growth model was most dependent on exports to the rich world. The next phase of China’s economic development, though, is entirely domestic, and involves a transition into non-tradeable service industries, and higher consumption on the back of rising middle class incomes. Meanwhile, China’s biggest trade interest is to have the renminbi accepted as a global currency, and that requires allowing markets to set the exchange rate on a daily basis.

Nevertheless, there is a debate within the economics profession on the role of protectionism in trade policy. Economics 101 teaches the theory of comparative advantage, first developed by classical economist David Ricardo. Country A might be three times better at producing hats and two times better at producing gloves than Country B, but A should specialise in making hat and B in gloves. If both countries trade the surplus they produce in each, they’ll both be better off. Britain may have a trade deficit in food and raw materials, but that frees its people to provide advanced manufacturing goods and world class financial and legal services.

Trade protectionism, however, has been a feature of US politics since its inception. The ‘infant-industry argument’ has been attributed to Alexander Hamilton, one of the Founding Fathers of the United States. He argued that industries need to be nurtured and protected by the state before they are exposed to international competition. “Tariffs, by enhancing the charges on foreign articles, enable national manufacturers to undersell all their foreign competitors,” he wrote in his 1791 Report on Manufactures.

Tariffs were imposed in the US in 1828 to protect manufacturing in northern states, and again in 1930 under the Smoot-Hawley Act with the intention to protect American jobs. Many economists have denounced Smoot-Hawley as one of the major factors that prolonged the Great Depression, but others such as Paul Krugman, who won the Nobel Prize for his work on New Trade Theory, and Ha-Joon Chang have supported trade protection for developing countries. The 1828 tariffs, according to this view, were more justified than the 1930 ones. While the world economy cannot afford for its most powerful engine to impose huge trade restrictions, it might make sense for smaller economies to develop their internal markets before facing the international competition.

Trade does make nations as a whole better off, but there are often losers from open markets who may not be adequately compensated either financially or through new employment. The focus therefore should be on ensuring that the benefits of trade are broad-based and shared by all citizens. A blanket 45% tariff on everything from the world’s second largest economy won’t cut it. Trump needs to go back to the drawing board rather than inadvertently attempting to overthrow American capitalism.